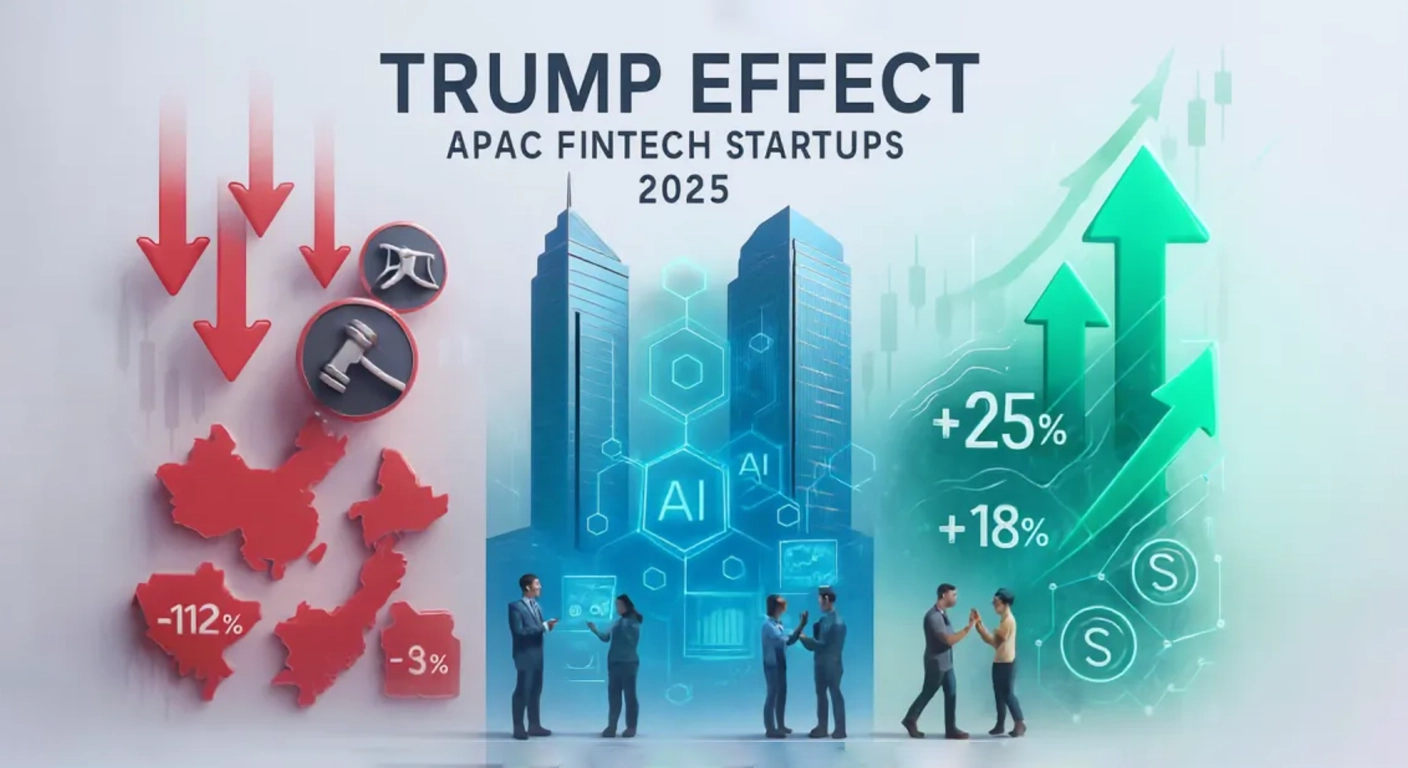

In Singapore’s fintech hub, where blockchain startups live harmoniously with digital banks, APAC (Asia Pacific) entrepreneurs have a brave new world in 2025. The so-called Trump Effect APAC Fintech 2025 – which consists of overly-aggressive tariffs (10% to 49% on 60+ nations including China and Vietnam), crypto-deregulatory policies, and trade primarily for America – has rattled many markets around the world. Across the APAC region, fintech funding fell 40% in Q2 2025 to $15 billion yet did secure over $11 billion in ‘deals’, and is clearly very resilient with sizable issues in India and Singapore. Tariffs have made cross-border payments more expensive, but the opportunities are rising in AI and finance use cases, DeFi (decentralized finance), and embedded finance. How can APAC fintechs convert trade wars into wins? This blog looks at the effects of the so-called “Trump Effect” on the APAC fintech sector and tracks some APAC fintech trends such as AI bucketization, adoption of stable coins and what’s changed in cross regional trade. The blog is full of references to scrappy startups and statistics from the wild markets of 2025, and gives you some ideas on how to deal with Trump tariffs impact, how to use deregulation, and build scale in an ever more fragmented world, with the vision to build APAC into a fintech powerhouse by 2028. 1. Decoding the Trump Effect: Tariffs, Deregulation, and APAC’s Fintech Landscape Tariffs Reshape Global Finance The tariffs imposed around Trump’s “Liberation Day” — 10% on our allies and 49% on China i.e., were devastating to APAC fintech. Global VC funding reached $109 billion for Q2 2025, however the APAC share was down 40%, due to inflation from tariffs after investor confidence diminished. Vietnam has 46% duties on tech exports to the U.S., taking payment solutions along with it, while China’s semiconductors are down 15% YoY (down 16% according to our data). On a positive note, India’s fintechs received $2 billion in seed funding and Singapore’s digital banks increased to 25% from 4% adoption in 2022. [Source: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/fintech-funding-falls-in-2024-but-mega-rounds-show-tentative-signs-of-optimism-80359390] Deregulation Sparks Crypto and Fintech Innovation The effects of Trump’s repeal of Biden’s AI executive order and proposed elimination of the Consumer Financial Protection Bureau (CFPB) has opened up fintech innovation in the U.S. This fintech deregulation has also caused a 25% increase in crypto payments with $3 billion in stablecoin payments in 2025 for cross-border payments. That said, less guidance on anti-money laundering (AML) has created a 25% chance increase of fraud with scams in 2024 with deepfakes costing $12.5 billion. Fintechs in APAC would have to balance opportunities in the U.S. against complying with their local regulatory requirements including the Monetary Authority (MAS) AI governance in Singapore. Currency Volatility and Trade Shifts Meanwhile, the rise of the U.S. dollar (funded by tariffs on the rest of the world) depreciated APAC currencies like the Chinese yuan and Vietnamese dong with losses of about 5-8%. Fintechs are flourishing, including those with blockchain-based online tools that provide hedges, like currency swaps. DeFi has raised an estimated $2.1 billion in the 1st Quarter 2025. Intra-ASEAN traded 15% more, all of which give relief to fintechs as they can circumvent tariffs from the U.S. and regional trade deals like RCEP, and CPTPP provide lifeboats to extra-regional trade compliance. 2. Top Fintech Trends in APAC: Thriving Amid Trump’s Trade Policies AI-Powered Personalization Redefines Finance AI is sweeping across APAC fintech. By 2025, over 77% of consumers will be using AI driven banking services. Generative AI is driving chatbots that are already handling 60% of queries in Singapore banks. Similarly, predictive analytics cut down fraud by 25%. Because Trump’s tariffs on chips (25% on imports from Asia) made AI infrastructure costs 15% higher, it is also now pushing startups to use large language models (LLMs) both locally (India) and in Asia (China), where 60% of APK companies report using hybrid AI. Jakarta-based neobank, for example, was able to design and implement bespoke BNPL plans for gig workers by leveraging AI, resulting in a 40% increase in retention rates, despite tariffs forcing price increases. Over the next 4 years, AI in fintech APAC could save banks $1 trillion in competitive cost structures, with Singapore being an established global hub for fintech. DeFi and Stablecoins: Tariff-Proof Growth I mean, explicitly, the measures taken by the Trump administration such as Executive Order 14178 explaining the compliance cost of digital assets have led to the expansion of DeFi in Asia. The sum paid in stablecoins has grown ten times since 2020 to more than 3 billion dollars and Singapore has also hosted the largest fintech festival ever in the world. Loaning platforms on blockchains collected 2.1 billion in Q1 2025, even though trade had been affected by new tariffs. A Bangkok-based start-up stablecoin serving regional trade in the ASEAN area reduced cross-border transactions by 30 percent, implying that we are entering the age of tokenization. This is a milestone of stablecoin adoption 2025 with tokenized assets expected to reach 20% of payments in APAC by 2028. Embedded Finance: Capturing Niche Markets Embedded finance, which is the provision of financial services through a non-financial platform, is on the increase in APAC. Embedded finance (via apps like Gojek) in the gig economy in Indonesia had a 50% adoption rate despite Trump tariffs driving up the cost of logistics (with 12% in export drop in Vietnam). Embedded finance has a huge potential as only 3 percent of banking revenue has been tapped. Embedded finance delivered a 35 percent jump in revenue based on monthly average business volume on a Malaysian e-com platform that embedded BNPL in hospitality. By 2026, embedded finance has the potential to generate 10 percent of SEA retail revenue, where ASEAN is expected to be a digital economy leader. Cross-Border Payments: RCEP as a Lifeline Payments between the US and APEC have been held up by tariffs, which have attached 46 per cent duty on Vietnamese technology exports. On a positive note, RCEP has pushed intra-regional payments up 20%. A startup

AI and Tariffs: Shaping 2025’s Venture Capital Trends

The venture capital (VC) environment in 2025 is in the throes of an evolution resulted from technological innovation, geopolitical changes, and economic policy developments. As of August 2, 2025, VC investment activity is consolidating into fewer, larger deals and the artificial intelligence (AI) vertical involves the majority of funding. This report prepared for Evolve Venture Capital (www.evolvevcap.com) summarizes and analyzes key trends in venture capital in Q2 2025: global funding trends, AI funding, and global tariff changes. We present these analyses as considerations in the “Global Trends” subcategory, designed to inform investors and startups in this rapidly-changing environment.For active VC and startup participants seeking opportunities and mitigating risks, understanding the trends listed below is important. It is our hope that by synthesizing data and expert observations, this report will add to the understanding of the current state of VC to help both identify problems and the opportunities for the remainder of 2025. Global Venture Capital Funding Trends Global venture capital (VC) financing was $97.2 billion across 5,336 firms in Q2 2025. This amount represents a 13% increase in financing from Q1 2025, but a 9% decrease in deals—this was the lowest amount of deals since Q4 2016. This suggests that investors are being more selective, concentrating their capital in fewer deals identified as high potential while investors express caution due to macroeconomic uncertainties. Regional Breakdown Region Q2 2025 Funding Q2 2025 Deals Q1 2025 Funding Change Americas $72.7 billion 3,425 $N/A +N/A United States $70 billion N/A $N/A +N/A Europe $14.6 billion 1,733 $16.3 billion -10.4% Asia $12.8 billion 2,022 $N/A +N/A China $4.7 billion N/A $N/A Lowest in 10+ years The Americas continue to be the focus for VC investing, especially the United States, with approximately 70% of global investment represented by the $70 billion invested in Q2 2025. Europe declined slightly in investment, dropping from $16.3 billion in Q1 to $14.6 billion in Q2, which signals this region is also experiencing caution in investor sentiment. Asia experienced a slowdown as well, where VC investment in China dropped down to $4.7 billion; the lowest in over a decade, in response to economic volatility, mixed policy and uncertainty. This variation regionally highlights the uneven materialization of global economic conditions, trade policies and market context in informing VC flow and activity. Investors are favouring those regions with stronger opportunities for innovation, such as a Stanford outlier like Silicon Valley, while shying away from the relatively higher perceived risks of venture investing in markets and conditions with lower societal trust. Dominance of AI in Venture Capital AI continues to be a pillar of venture capital investment, capturing 31% of total VC funding in Q2 2025 and down from 35% in Q2 2024, but still a sizable portion. One in five venture-backed deals now involve AI and early-stage deal sizes continue to creep upward as investors continue to bet on the AI sector and its potential to drive transformative change. Notable AI Deals in Q2 2025 Company Region Amount Raised Sector/Application Scale AI United States $14.3 billion AI Infrastructure Anduril Industries United States $2.5 billion AI-Powered Defencetech Safe Superintelligence United States $2 billion Early-Stage AI Development Thinking Machines Lab United States $2 billion AI Seed Round Anysphere (Cursor) United States $900 million AI Coding Assistant Helsing Germany $683 million AI Defence Tekever Portugal $500 million AI Technology Quantum Systems Germany $177 million AI Systems Zelos Tech China $300 million Autonomous Logistics Saic Mobility China $178 million Mobility Platform These deals demonstrate that AI is broadly appealing across regions and applications for various purposes, from AI-based infrastructure and defence to logistics and coding assistants. One significant trend amid the broader stack of AI-related deal activity is the commercialization of AI agent technology. In a December 2024 survey of over 800 organizations, 63% of organizations said AI agents were of high priority. Over 50% were organizations that were founded after 2023. Corporate venture capital (CVC) activity also highlights the strength of AI, with over 65% of CVC deals in 2024 targeting early stage AI start-ups. A focus by the market on AI, and there will be concerns over market saturation and/or sustained high valuation assumptions, particularly for early-stage companies. Like Safe Superintelligence which raised a double unicorn valuation of $2 billion + with a mere 10 employees. Impact of Tariff Reforms on Venture Capital Tariff reforms, specifically the US Liberation Day tariff announcements of April 2, 2025, have created net new hurdles for the VC market. Tariff reforms have exacerbated fears about global trade and supply chains, resulting in a more conservative approach by investors. There is growing pressure and exposures to tariffs in verticals such as AI with large infrastructure costs and international business. Tariff exposures create unnecessary hurdles to growth and ultimately ruin investor confidence. Strategies for Startups To respond effectively to these changes in the VC market, startups should deploy a comprehensive tariff strategy, including: In this chaotic and uncertain investment space, founders should show expertise in their sourcing strategy, trade compliance, and tariff exposure management, to obtain an investment. Tariff strategies are critical for AI startups as infrastructure spend is paramount to scalability and profitability. Other Notable Trends Despite the continued dominance of AI, other segments present varying performance: Fintech: deal volume has reduced, now recording the lowest volumes since 2017, and is a reflection of current investor caution based on regulatory and economic uncertainty. Climate Tech: funding is currently being tracked at a multi-year low, but interest in sustainable solutions remains consistent. Defencetech, Healthtech, and Biotech: are all performing positively, especially when there is a clear roadmap for future applications. M&A activity continues to be strong, most prominently seen in AI driven technology. Large billion-dollar deals demonstrate possible consolidation around certain areas such as AI agents and voice AI. The outlook for Q3 or 2025, suggests that VC investment is expected to stay very low thanks to the uncertainty created by US tariff policy and new relevant tax bill. There nevertheless remains an appetite from investors to back AI,

How Savvy Investors Are Unlocking New Opportunities with Evolve Venture Capital

Hey investor! If you’re here, you’re probably looking to find ways to make your money work harder. You most likely have a great portfolio, likely a mix of stocks, real estate, or even some riskier investments in startups. But let’s be real, the investing landscape today is like trying to navigate through a labyrinth in the dark. New opportunities pop up all the time, markets change on a dime, and figuring out where to put your money can feel like a poker hand. That’s why we’re going to discuss how intelligent investors are changing their investment strategies and why you should consider a partnership with Evolve Venture Capital. Let’s go! This is going to be fun! The Investor’s Puzzle: Too Much Noise, Not Enough Signal Let’s say you at your desk, coffee in hand and scrolling your news app. One headline announces a new AI startup that is “changing the world.” Another announcement tips off a massive tech bubble. Ping, in your inbox is a pitch deck from the founder of a startup declaring they will be the next big thing. Meanwhile, your buddy from the golf course will not stop talking about the next big crypto opportunity. It’s infinite and exhausting. Too much information and opportunities can overwhelm even the best investors. But it is worse than just determining the best investment opportunity. You have to consider what investment opportunities align with your goals for returns, risk tolerance, and timing. Should you invest in the green energy startup, hold off on unstable growth, play it safe with dividend stocks, or become a limited partner in private equity? Without clear objectives, you will consistently guess—and be in fear, and second guess—every decision. And the time spent researching each opportunity? Yeah, that’s hours you can NEVER get back. This is where a lot of investors get stuck. They have the money and the drive, but the complexity of today’s markets benefits them little in getting ahead of the game. This is another reason why more people are rethinking how they invest; unfortunately for investors but best for researchers, figuring out what really matters is incredibly complex. The New Playbook for Smart Investing So what’s going on? First, the investment game has changed. The good old days of simply investing in index funds and waiting for retirement are over. Today’s markets involve innovation; biotech, blockchain, sustainable technology. Venture capital has never been so popular and according to a 2023 report from CB Insights, over $350 billion was invested globally in what people have been referring to as “cutting-edge” startups last year. It’s an exciting time but a time where we have to be quick and smart. One of the major shifts we are seeing is the alternative investment space. Whether looking at venture capital, private equity, or various niche areas like impact investing are taking people’s attention. Why? Because they can generate returns that traditional markets often cannot approach. There is a catch though – these type of transactions are more difficult to navigate. They can be less liquid, require deeper analysis, and often require certain insider knowledge to be able to know which are good ones. This is why investors are often partnering with professionals who can navigate the nuances for them. Another area worth discussing is how easily investors are able to access deals now. Technology has allowed investors to invest in startup businesses and projects that were previously only accessible to a very wealthy audience. There are now many new avenues for investing through angel networks and crowdfunding sites. With the accessibility has also come a ton of options, with potentially hundreds of start-up businesses competing for your attention. It is a full-time job to sort through them to find the good ones. And, this is therefore before you add in the requirements for due diligence, and market research, and potential exit planning, having you potentially spending more time dealing with the paperwork if you are using your own research rather than just the access opportunities. Therefore it is completely understandable investors want a better way. Why Flying Solo Might Hold You Back Let’s talk about going solo. Certainly, many investors enjoy the thrill of running down deals and making instinctual decisions. Alumni love the adventure, and there is nothing wrong with that—your instincts have served you well. All I’m saying is that, even the best hunters use guides when exploring unfamiliar territory. No one can know everything about every industry or startup, and although you may be incredibly knowledgeable, going too alone may cause you to miss breath-taking opportunities. Take the following for example: you are renovating your home—would you try to renovate without a contractor? No, you would choose a contractor that had the knowledge and tools to do it correctly. Investing is no different. By partnering with a firm with venture capital as their Passport to Success, you are getting the information, social capital, and deals that you may not have found on your own. Further, you can keep your eyes on the prize out there—whether that is to scale your business, determine your next plans, or just relaxing with your family. Why Venture Capital Is the Place to Be Now, let’s focus on venture capital. It’s seriously one of the most exciting places for investors right now. There is no better experience than when you invest in an early-stage company. You are not just buying shares; you are a part of building the future! Whether it is a startup changing the dynamics of healthcare, developing the next “need to have” app, or attempting to mitigate climate change, you literally start from the ground floor. There is nothing better than being part of that! However, venture capital is not easy! For every company that hits it big, there are many, many more that fail. The problem is knowing how to identify the winners. To do this, you will need to know how to research, have industry knowledge, and back founders that have the vision

Navigating the Regional Markets: A Venture Capital Perspective

In today’s competitive and fast-paced venture capital environment, the understanding of regional markets is essential, not optional. As investors look for high-growth potential ventures and startups look to become known in their business, the regional nuances may propel the venture to success or be the demise of a promising startup. This report will provide the reader with a comprehensive understanding of regional markets and relevant insights for investors and startups. Global Venture Capital Market Overview The global venture capital market is growing everywhere. According to the business research company, in 2025 the market size is projected to become 412.58 billion, which also represents a cagr of 10.3 % from 2025 to 2034. In 2020 the venture capital market reached $191.5 billion and that growth is attributed to: environmental factors (technological), economic and advances in investment strategies. Regional Market Analysis North America North America, and the u.s. in particular, is still the colossal player in the venture capital sector. The U.S VC market is going to bounce back in 2025 due to ai evolvement, tech ipos and frontier tech like electrification. The federal reserve’s interest rate cuts have increased liquidity and risk appetite, allowing tech companies to pursue public listings. The North America VC ecosystem is also supported by an existing and relevant ecosystem of investors, startups, and research institutes.. Europe In Europe, the unicorn herd has remained stagnant in 2024 but venture capitalists are optimistic about a recovery in deal flow and valuations in 2025 with enthusiasm from the ai sector. The u.k., Germany and France remain key areas in the European venture capital market. The u.k government has created programmes like the enterprise investment scheme (eis) and the seed enterprise investment scheme (seis) to stimulate venture capital growth. The German venture capital market is spatially concentrated in Berlin and Munich, while the French ecosystem is largely focused in paris. Asia-Pacific The Asia-Pacific markets are seeing more interest because of similar reasons – rapidly growing digital economies and favorable government and policies. Southeast Asia is attracting the lion’s share of investments in e-commerce, fintech and edtech platforms. The venture capital markets in the Asia-Pacific region place an emphasis on technology startups that have the potential to disrupt existing industries and transform or reshape economies. Policy makers are creating more favorable environments for venture capital development through new tax incentives and direct funding programs. Latin America and Africa Emerging markets are undergoing a technological revolution, fueled by youth and a tech-savvy population. The dominant areas of investment are fintech, agritech, and renewable energy tech. The Latin American venture capital market is a hot topic because of the potential for high growth, while Africa’s venture capital market is drawing attention due to its rapidly growing digital economy and landscape and favorable policies from governments. Industry Evolution Data-Driven Decision Making Venture capital firms are becoming more reliant on predictive analytics, real-time measurements and performance tracking, and sophisticated algorithms for evaluating and managing investments. The data-driven nature of this approach improves accuracy in decision-making and operational efficiencies. By using tons of data, professional venture capital firms evaluate and identify potential startups, understand risk, and make informed investment decisions. Focus on Sustainability and ESG Sustainability and esg (environmental, social, and governance) factors are increasingly becoming trendy buzz words within the better portion of the venture capital industry. Clearly defined ESG considerations are increasingly important to investors when evaluating and selecting potential investment in startups. Investor awareness of the importance of sustainable development and corporate social responsibility is particularly high at this moment, for good reason. Sustainable investing and management expectations for corporate impact are just beginning in venture capital. Some venture capital firms are integrating ESG criteria into their investment decision-making processes to find startups that fit sustainability-oriented investing. Rise of AI and Machine Learning AI and machine learning continue to be leaders in venture capital investment portfolios. The ai market is predicted to have a 35% cagr from 2021 to 2025, which would place the market size above $500 billion. investment into ai startups is expected to increase to $160 billion by 2025, up from $70 billion in 2021. The most important areas of growth include generative ai and large language models, applications across sectors, and edge ai. Convergence of VC and PE The traditional dividing line between venture capital (vc) and private equity (pe) is fading. Principal investors, who function across the investment spectrum, are becoming more prominent. This means that, increasingly, startups will have investors who can provide a combination of capital supply, operational expertise and strategy. Key Metrics Fundraising Metrics The total amount of capital raised, the number of capital raises, and the average fund size indicate the level of capital available in the venture capital market. In 2023, the number of mega rounds (greater than $100 million) was approximately half of that in 2022. However, the roughly 600 mega rounds are still double from 2017. Investment Metrics The indicators include the totals for amount invested, number of investments, and the average size of investment. In 2023, compared to 2022, early-stage and late-stage investing was down by 2% and 8% respectively and down by 40% for pre-seed and seed stage investments. Compared to 2021, pre-seed and seed stage investing was down 22%, early stage down 55%, and late stage down 48%. Exit Metrics This includes the number of exits, amounts of exits, and exit valuations. If there is not an active exit market, many venture-backed companies will need to raise capital in 2024. Getting raised capital in a tough financing environment may mean accepting terms that are not as favorable. In Q3 2023, 17% of all venture financings were “down rounds” which is the highest amount in a decade. Industry Trends and Challenges Trends Technological advances will continue to influence the venture capital sector profoundly. Key opportunities remain in areas such as ai, big data analytics, blockchain, and biotechnology. Digital transformation is also a top trend, with traditional industries using technology to transform or upgrade when possible. The growth of

Innovation Is Overhyped—Here’s What’s Actually Worth Your Time and Investment

In 2025, the world stands at the crossroads of a new technology revolution. The convergence of artificial intelligence, quantum computing, blockchain, and other new technologies is still reshaping industries, disrupting traditional business models, and altering economic fundamentals across the world. Being an early mover venture capital company, Evolve Venture Capital has always been at the forefront of tracking and researching global innovation trends. That which comes next is an extensive review of emerging global innovations as well as industry trends, alongside detailed analysis and insights. Global Innovation Landscape Overview The international innovation environment has, over the last few years, been characterized by an extremely dynamic and fast-changing trend. As the United Nations Conference on Trade and Development (UNCTAD) Technology and Innovation Report 2025: Inclusive Artificial Intelligence for Development highlights: Frontier technologies such as artificial intelligence are leading the cutting-edge transformational changes in wide-ranging socio-economic domains, especially in the developing world. They are transforming industries and opening new development pathways. The fast pace of generative AI has drawn extensive attention. Its uses range from content generation, customer support, to education, boosting productivity and efficiency gains. While quantum computing continues to make waves, its computing power is set to unleash breathtaking breakthroughs in areas such as cryptography, material science, and finding cures for diseases. Blockchain technology is, nonetheless, diverging from its source of utilizing financial applications to other uses in supply chain management, protection of intellectual property, etc., creating new solutions to numerous industry challenges. Key Innovation Trends and Analysis Artificial Intelligence and Machine Learning: Pioneering the Industry Revolution Artificial intelligence and machine learning are the engines of innovation around the world. Latest advances in AI have revealed unprecedented possibilities across various sectors. To give an example, AI technologies in medicine have improved diagnosis accuracy and the effectiveness of treatment significantly. Diagnostic software based on artificial intelligence can read medical images faster and with a level of accuracy that is beyond human capabilities and identify disease conditions such as cancer and cardiovascular disease at the initial stage. For banks, AI technology is easing investment planning and risk management, and in manufacturing, automation technology made possible by AI is improving the efficiency of production and reducing the cost. Another notable trend is the expansion of AI-augmented development. Developers can increase the efficiency of their coding and testing by introducing AI into the software development process. AI technology may detect and correct code flaws automatically, generate code snippets depending on requirements, and even anticipate potential difficulties during the development stage. This not only reduces project time but also improves software quality. Furthermore, as generative AI becomes more accessible, more individuals and businesses will be able to employ it. Platforms such as Google’s Bard and OpenAI’s GPT series are lowering entry barriers and fostering widespread creativity by making AI technologies more accessible. Also Read : Investor and startup opportunities Quantum Computing: Unlocking New Research Potentials Quantum computing is also an innovation leader. The recent progress in quantum computing has brought it to the verge of practical use. To give an example, quantum algorithms have been created to solve some very complex mathematical problems much faster than regular computers. Here the possibility is enormous in a variety of applications from cryptography to materials science and pharma. In cryptography, quantum computing can potentially crack classic encryption algorithms, and therefore quantum-resistant cryptographic methods are needed. In material science, quantum computing can compute the molecular structures of materials with unprecedented accuracy, enabling new materials to be discovered sooner. In the pharmaceutical industry, quantum computing can speed up drug discovery, saving R&D cost and time. But even quantum computing application in real life remains in a negative stand. Quantum computers must be operated in very cold conditions, and stability and coherence preservation remains technologically challenging. Nevertheless, with the technology of quantum computing continuing to evolve even more, its potential to revolutionize industries will be clearer. Blockchain Technology: Beyond Cryptocurrency Blockchain technology is transcending its historical association with cryptocurrency to find its applications in other sectors. Blockchain can offer traceability and transparency in supply chain management to enable products’ origin, transport route, and storage condition to be traced in real-time. This helps businesses make supply chains more efficient and trustworthy as well as resolve the customers’ authenticity demand. In intellectual property rights protection, blockchain can be used as an unbreakable book to identify the origin and ownership of intellectual property and protect creators’ rights. Blockchain technology is also experimented with vote systems and electronic identity authentication, opening up new opportunities for enhanced security and equity. 5G and IoT: Connecting the Future The rollout of 5G networks is also being extended, enabling IoT connectivity faster and more efficiently. The low latency and high bandwidth of 5G make it suitable to employ in IoT applications with the ability to connect devices seamlessly. IoT and 5G are also being employed to develop smart cities, making smart transportation systems, smart grids, and smart healthcare facilities. Autonomous vehicles, for example, utilize 5G networks to communicate with other vehicles and roadside infrastructure in a bid to drive safely and optimally. 5G IoT sensors on farms can measure real-time soil temperature, water level, and plant development phase, enabling farmers to maximize planting and harvesting processes along with farm yields. Augmented Reality (AR) and Virtual Reality (VR): Redefining Human-Computer Interaction AR and VR technologies continue to be more common in entertainment, learning, and training. In gaming and entertainment, AR/VR provides experience that enables users to interact with virtual reality worlds as if they were part of physical reality. In learning, AR/VR can create virtual classrooms and laboratory settings for the students to have experiential hands-on learning beyond the classroom. In professional training, AR/VR simulation allows students to learn complex procedures in a simulated setting, maximising the effectiveness of training and reducing risks. For instance, medical students can employ VR technology to perform test surgeries, gaining much-needed practice without endangering real operations. Sustainable Technology: Addressing Global Challenges Sustainability is a significantly significant field of global innovation. Technologies such as

Strategic Investor Leadership: Creating Value Beyond Financial Investment

In an era where capital is abundant but differentiation is scarce, the role of the investor has evolved far beyond merely supplying funds. Today’s Strategic Investor Leadership demands a multifaceted approach that prioritizes Value Creation through non-monetary contributions. This shift acknowledges that while financial resources are foundational, the most impactful investors are those who act as catalysts for growth, mentors for founders, and architects of thriving ecosystems. For Evolve Venture Capital, this philosophy isn’t just a trend—it’s the cornerstone of our mission to empower investors who seek to drive meaningful, lasting outcomes. The Evolution of Investor Roles: From Check-Writers to Strategic Partners Historically, venture capital was synonymous with writing checks. Success was measured in exit multiples, and relationships were transactional. However, the modern startup landscape demands a different playbook. Startups now operate in hyper-competitive markets, where speed, adaptability, and access to resources can make or break a venture. Investors who recognize this reality are redefining their roles as Strategic Investor Leaders—entities that contribute not just capital, but expertise, networks, and strategic vision. Consider the following analytics from a 2024 study of 500 venture-backed startups: These statistics underscore a fundamental truth: Value Creation extends far beyond the balance sheet. Investors who prioritize strategic engagement become indispensable partners, fostering resilience and scalability in their portfolios. Non-Financial Investor Contributions: The Hidden Levers of Success When investors step into the arena of Non-Financial Investor Contributions, they unlock unique avenues for Value Creation. These contributions fall into three key categories: Building Startup Ecosystems: The Ripple Effect of Collaboration A single investment can catalyze an entire Startup Ecosystem. Strategic investors understand that healthy ecosystems—comprising founders, corporates, academia, and policymakers—create a flywheel of innovation. By nurturing these networks, investors amplify their Long-Term Investor Impact. Consider the case of Silicon Valley’s rise: early-stage investors like Arthur Rock didn’t just fund companies; they built communities. Today, Evolve Venture Capital adopts a similar ethos through initiatives like our Ecosystem Hubs, regional centers designed to connect startups with local resources. In 2024, our Austin Hub helped launch 12 startups, 70% of which secured follow-on funding within 12 months. Key strategies for ecosystem-building include: Long-Term Investor Impact: Measuring What Matters While exits capture headlines, the most sophisticated investors focus on Long-Term Investor Impact—metrics that reflect enduring value. These include: At Evolve, we’ve developed the “Impact Dashboard”, a tool that tracks these KPIs alongside financial returns. For instance, one portfolio fintech startup not only achieved a 5x return but also created 300+ jobs in underserved regions. This dual focus aligns with the growing demand for Value Creation that resonates beyond shareholders. How Evolve Venture Capital Empowers Strategic Investors At Evolve, we recognize that Strategic Investor Leadership requires more than intuition—it demands frameworks, data, and community. Here’s how we support investors: Leadership Redefined The future of venture capital belongs to those who grasp that Value Creation is an art as much as a science. By embracing Strategic Investor Leadership, investors become architects of ecosystems, mentors to founders, and stewards of sustainable growth. Evolve Venture Capital stands ready to equip you with the tools, networks, and mindset to lead in this new paradigm. Ready to elevate your approach? Contact us at contact@evolvevcap.com to explore how Evolve can help you create value that transcends the balance sheet.

2025 Tech Sector Insights: Trends, Opportunities, and Challenges

AI Dominates the Tech Sector Generative AI Evolves into Reasoning AI Agents In 2025, generative AI continues to develop from simple content generation to more advanced reasoning AI agents. These autonomous smart systems are able to learn and evolve to meet new situations, driving efficiency and decision-making across industries. 70% of business leaders and 85% of investors, as quoted by Capgemini, have AI agents in their top three influential technologies of 2025. The potential of AI agents is limited until such time that they can be used to make transactions with ease. A handful of technology players are building new infrastructure to enable AI agents to execute orders, a move that could revolutionize e-commerce and business applications. AI and Gen AI in Cybersecurity: New Defenses, New Threats Artificial intelligence is revolutionizing the cybersecurity world. It comes with advanced defense systems, but with them come new vulnerabilities as well. Microsoft’s 2024 Digital Defense Report states that AI-powered phishing attacks can bypass 89% of traditional email filters. But defense systems like Darktrace’s application of neural networks identify anomalies 40% faster than human analysts. The EU’s NIS2 Directive requires all public companies to implement quarterly cyberattack simulations by 2025. Missing response time goals can cost companies up to 2% of global revenues in fines. With AI more and more of an embedded part of security, companies have to walk the fine line between innovation and security. AI-Driven Robotics: Blurring the Line Between Human and Machine AI-based robotics is revolutionizing workplaces. Autonomous robots and collaborative robots (cobots) are improving productivity and safety. With robots increasingly autonomous and AI performing complex decision-making tasks, workplace hierarchies might change. Siemens, for instance, employs HoloLens 2 to assist in turbine repairs, cutting service time by 25%. Yet, the absence of a “killer app” for AR/VR continues to pose a challenge. Enterprise applications could propel the adoption of spatial computing technologies in 2025. AI Fuels Nuclear Resurgence The increasing need for clean, secure energy to fuel AI and other high-energy tech is propelling a nuclear revival. Small modular reactors (SMRs) are likely to be at the center of it. By 2025, SMR technology could meet energy needs while minimizing carbon imprints. The CHIPS Act’s $52 billion subsidy pool has also had an impact on the tech industry, with Qualcomm relocating 18% of its chip design employees from California to Vietnam. As supply chains regionalize, mid-sized tech companies have difficult decisions to make: absorb 20-25% cost hikes for “trusted” components or risk being shut out of Western markets. Other Key Tech Sector Trends The Rise of RNA Therapeutics RNA therapeutics is on the verge of becoming a fast-emerging area. Developers are opening up new medicines for traditionally “undruggable” conditions, and an increasing interest is being placed on neurodegenerative disorders such as Alzheimer’s and Huntington’s diseases. Floodgates of investment are opening for RNA therapeutics, creating new prospects for investors and startups. AI M&A Drives Corporate Strategy Since 2020, we’ve seen a significant uptick in the role of AI within corporate IT mergers and acquisitions, with its share actually doubling. To keep up with the rising demand from businesses, major players like Nvidia, Salesforce, and Snowflake, along with consulting powerhouses like Accenture, are quickly snapping up AI startups. This trend not only highlights how crucial AI has become but also opens up valuable exit opportunities for companies that are focused on artificial intelligence. Retail Personalization with Generative AI Generative AI is driving personalized retail. Leaders like Target have achieved three times their conversion rates through 1:1 personalized experiences. Personalization is becoming a major value proposition for retailers. More retail marketing and customer experience innovation will be driven by generative AI in 2025. New-Generation Supply Chains: Agile, Greener, and AI-Assisted Businesses are making efficiency, resilience, agility, circularity, and sustainability of the supply chain their top priority as a result of a rapidly changing and complicated market environment. The technologies that have been spearheading this include AI, data analytics, blockchain, IoT, and ground-satellite network connectivity. LiveRamp’s customer data-anonymizing clean room technology, for example, experienced triple-digit greater adoption over the previous year. At the same time, Walmart’s media network also now brings more ROI to 60% of CPG brands than Meta ads. Supply chain innovation in 2025 will be focused on cost reduction and sustainability. Opportunities and Challenges for Tech Investors and Startups Opportunities High Growth Opportunities: The AI sector holds a growth opportunity at a CAGR of 36.9% during the period 2023-2030. AI, cyber security, robotics, and other high-growth start-ups hold high investment potential. Diversified Investment Opportunities: From AI agents to RNA drugs, the technology space offers opportunities for investment. A diversified investor can diversify either in terms of spaces or stages. Policy Support: State policies like the EU’s NIS2 Directive and the CHIPS Act guide and support technology development, maintaining the ecosystem favorable to startups and investors. Challenges Intense Competition: The technology industry is very competitive. New companies have to innovate every day to be competitive, and investors have to make excellent judgment to find high-potential companies. Technical Risks: Technical risks are involved with emerging technologies such as AI and robotics. For instance, AI-generated content will be inaccurate and unreliable, whereas self-reliant robots must improve perception and decision-making.. Regulatory Risks: More advanced technology means tighter regulation. For example, the EU Digital Markets Act imposes higher regulation on technology companies, which add to the burden of compliance for startups and investors. Evolve Venture Capital’s Perspective and Recommendations For Tech Investors Enhance Market Research: Track technological advancements in emerging markets, especially in emerging areas such as artificial intelligence and RNA treatments. Leverage data and industry research to discover high-growth areas that offer opportunities for investment. Maximize Investment Portfolios: Spread investments across industries and stages to reduce risks. Mix high-risk, high-reward startups with low-risk, stable technology companies. Enhance Risk Management: To determine and control technical as well as regulatory risks, implement effective means of risk management. Conduct periodical monitoring of investment strategies and accordingly modify them in the light of market variations. For Tech Startups

The Chaos Survival Guide: Investor Tips for Thriving in Turbulent Tech Markets

The Battlefield of Tech InvestingTech investing isn’t a spreadsheet—it’s a storm. Markets shift like quicksand, startups explode or vanish overnight, and the “next big thing” often turns out to be a smoldering crater. But here’s the secret: chaos isn’t your enemy. It’s your playground. In this guide, we’ll rip apart conventional wisdom and arm you with strategies that don’t just weather the storm—they ride the lightning. Forget the vanilla playbooks. This isn’t about “risk management” or “due diligence checklists.” It’s about surviving (and thriving) when the rules break down. 1. The First Rule of Chaos: Stop Predicting, Start Adapting Tech investors love forecasts. Analysts promise 10-year growth curves, AI charts show hockey sticks, and everyone pretends they can see around corners. But here’s the truth: No one knows the future. Even the savviest VCs miss paradigm shifts. Case Study: The “Dotcom Bubble” RebootRemember when everyone laughed at Webvan? Now Instacart is a unicorn. What changed? Not the idea—it was the timing, infrastructure, and consumer readiness. The lesson? Don’t judge a pitch by its historical failures. Adaptability trumps “proven models.” Actionable Tip:Build a “chaos portfolio.” Allocate 20% of your capital to high-risk, high-uncertainty bets. Why? Because the next Airbnb might look like a glorified hostel app today. 2. Love Your Losers (They’ll Teach You More Than Winners) Winners get parades. Losers get post-mortems. But here’s the irony: Your failed investments are your best teachers. The Anti-Post-Mortem StrategyMost investors review failures to avoid repeating mistakes. Smart investors dissect why they almost succeeded. Was it timing? Team execution? A competitor’s pivot? Real-World Example:A SaaS startup you funded tanked because their sales team couldn’t close enterprise deals. But their product? Brilliant. Two years later, the founder pivoted to a no-code platform—and it’s killing it. You missed the pivot. Why? Because you fixated on the failure, not the potential. Actionable Tip:Create a “Failure Library.” Document every missed opportunity, pivot, or near-miss. Review it quarterly. Your future winners are hiding in those pages. 3. Bet on Outliers, Not “Safe Bets” Safe bets are for banks. Tech investing rewards the weird. The companies that defy logic—Tesla, Coinbase, OpenAI—weren’t “safe.” They were outliers who rewrote the game. Why Outliers Win: Actionable Tip:At Evolve Venture Capital, we use the “3X Factor” framework: 4. The Dark Art of Reading Founder Psyche Spreadsheets don’t build companies. People do. And in chaos, psychology trumps numbers. The “3 AM Test”Ask founders: “Walk me through your last major failure. How did you handle it?” Their answer reveals: Red Flags: Actionable Tip:Invest in founders who enjoy chaos. Look for those who light up when discussing crises. Their passion for problem-solving is your best ROI. 5. Use Chaos as a Weapon Recessions, regulatory crackdowns, and market panics scare most investors. Use them to your advantage. Case Study: The 2020 PivotWhen COVID-19 crushed travel, a travel-tech startup we funded pivoted to virtual event platforms in 48 hours. They’re now dominant in hybrid conferences. Why? Because chaos forced speed—they had no choice. Actionable Tip:Create a “Chaos Fund”: A slush fund for deals that emerge during market panics. Example: When crypto winter froze VCs, we backed a DeFi protocol that solved liquidity issues—now a market leader. 6. The “Anti-Portfolio” Strategy Investing isn’t just about what you buy—it’s about what you avoid. Build Your Anti-Portfolio:Track companies you passed on. Why? To spot patterns in your blind spots. Did you miss three AI startups because you hated their valuations? Maybe AI is a sector you need to revisit. Pro Tip:If 80% of your anti-portfolio is in one sector, you’re either a genius… or missing a trend. 7. The 100-Year Mindset Tech moves fast, but true value is built slowly. Think like a time traveler: What will people need in 2123? Examples: Actionable Tip:Reserve 10% of your capital for “100-year bets.” These are moonshots that might take decades to pay off but could redefine industries. Embrace the Storm Tech investing isn’t for the faint-hearted. It’s for those who see chaos not as a threat, but as a canvas. By adapting faster, loving your failures, and betting on the irrational, you turn turbulence into terrain. Final Challenge:Next time you’re analyzing a deal, ask yourself: “Does this make me uncomfortable?” If the answer is yes—dig deeper. That discomfort is where the magic happens. Evolve Venture Capital – Because the best opportunities aren’t found on Excel sheets. They’re forged in the fire.

Global Financial Market Trends in 2025: Opportunities and Challenges

With May 2025, the financial market scenario continues to change and evolve dynamically in the world. For startups and tech investors, it is always important to get updated on the trends to reap investment opportunities as well as create business strategies accordingly. In this report, based on the insight of financial analysts, financial advisors, and the investors, the global financial market trends will be analyzed and great insights will be provided for the startups and the tech investors. I. Global Economic and Financial Market Overview Macroeconomic Environment By 2025, the world economy presents a rich and varied picture. While inflation and interest rate volatility strike the U.S. and European developed economies, the developing markets present robust growth prospects. The April 2025 World Economic Outlook report by the IMF states that global economic growth will be fairly stable, with the developing markets making a major contribution to growth. The monetary policy decisions of the U.S. Federal Reserve continue to be in the spotlight, as they have the potential to affect cross-border capital flows and market stability. The European Central Bank, on the other hand, is monitoring inflation rates closely and making the corresponding monetary policy adjustments. Japan’s economic rebound is on the horizon, while the Bank of Japan is gradually inching towards policy normalization. Financial Market Performance Equity Markets: Global equity markets have recorded significant regional and sectoral diversity. The US stock market remains the world’s leader in equity markets, with technology stocks still dominating market performance. During the first quarter of 2025, top US stock indexes such as the Nasdaq Composite Index appreciated around 10%, a reflection of investors’ faith in the growth potential of the technology sector. European stock markets have been fueled by the eurozone’s economic recovery and geopolitical factors. The UK FTSE 100 Index and the German DAX Index have experienced fluctuating trends but are overall relatively stable. Emerging market equity markets are good prospects, with India and Southeast Asia being of particular interest to increasing numbers of international investors due to their high rates of economic growth and demographic dividends. Bond Markets: Global bond markets have been influenced by interest rate policy and inflation expectations. Yields on U.S. Treasury securities followed the path of Federal Reserve interest rate tightening as well as economic conditions. The 10-year U.S. Treasury yield bottomed out and came to rest at about 4% by the beginning of May 2025.The European and Japanese bond markets have also experienced the yield adjustment process.Investors are increasingly concerned with bond market risk and return, shedding portfolios by altering the proportion of central government bond, corporate bond, and other fixed income assets. Foreign Exchange Markets: The dollar’s exchange value has been influenced by Federal Reserve policy and global economic conditions. During the early part of 2025, the U.S. dollar index has fluctuated but remained generally within a relatively stable range. The euro, yen, and other major currencies have fluctuated moderately to slightly against the dollar. Emerging market currencies have been shaken by external debt risk and capital flows but have remained resilient in a growth and reform environment. II. Key Trends in Global Financial Markets Digital Finance and Fintech Innovation Digital finance is still redefining the global financial scenario. Mobile payment technologies have grown at a faster pace, and mobile money services have become progressively widespread. GSMA’s report in April 2025 cites that at the end of the year 2024, 336 live mobile money services operated across the globe, a marginal increase from the 334 registered in 2023. The volume of transactions in mobile money increased by 12% during 2024, while cross-border remittances through mobile money increased higher than other types of ecosystem transactions. Mobile money-facilitated international remittance transaction volumes grew by 22% to $534 billion. Fintech growth has prompted financial institutions to speed up digitalization.Artificial intelligence, blockchain, and big data technologies are being utilized to assess risks, make investment choices, and settle payments, enhancing financial service efficiency and cost reduction. For technology startups, the fintech segment has much potential, with payment, lending, and wealth management being highly attractive for venture capital investment. Sustainable Finance and Green Investment Sustainable finance is more and more of a global trend. ESG issues are more on the radar of today’s investors when deciding on investments. Global sustainable investment assets totaled $35.3 trillion in 2023, a 12% increase from 2021 levels, based on a report issued by the Global Sustainable Investment Alliance in 2025.Governments and regulators across the globe are implementing policies to drive green finance, including green bonds and climate financing frameworks. Financial institutions are working actively to create green financial products and services based on market demand. To tech start-ups, there are opportunities in clean energy, energy storage, and other green technologies where growth and innovation possibilities can attract sustainable investors. Cross-Border Investment and Global Asset Allocation International economic integration propels cross-border investment and international asset allocation. Technology investors are looking beyond their borders to pursue high-growth investment opportunities in emerging markets. Startups are also turning towards international capital markets for funding and collaboration. Cross-border investments, however, come with risks like currency volatility and geopolitics. Investors must carry out substantial research in target markets, evaluate risks, and frame diversified investment plans. Financial experts and analysts have a key role in guiding investors through global asset allocation by presenting market trends and investment guidance. Regulatory Changes and Compliance Requirements Regulations in financial markets are still changing to address market trends and risks. Regulatory agencies across the globe are enhancing regulation of fintech, cryptocurrencies, and other new financial industries to safeguard investors’ interests and ensure financial stability. For instance, the European Union’s Digital Markets Act and other regulations have imposed more stringent requirements on the operations of tech companies and data privacy. Technology startups and investors need to keep abreast of regulatory developments to maintain compliance and mitigate legal exposure. Financial analysts can help companies understand regulatory needs and build compliance strategies. III. Role of Financial Advisors, Financial Analysts, and Investors in the Current Market Environment Financial Advisors Financial

Global Tech Industry Trends in April 2025: Opportunities and Challenges

In the fast-paced, ever-changing global tech scene of today, it is vital for tech startups and investors to remain ahead of the curve with regard to industry trends. Entering April 2025, there are various major trends shaping the tech industry. This report explores the current global tech trends, offering informative insights for startups and investors navigating the competitive world of tech. AI Dominates the Tech Landscape Artificial intelligence (AI) remains a dominant force shaping the tech industry. Forecasts indicate the market for AI may reach more than $1 trillion by 2030, with growth dominated by generative AI. Generative AI is growing at a record rate, although the sector suffers from hardware shortages and talent shortages. As technology in AI continues to mature, its use is spreading across industries. For example, in the cybersecurity field, AI is revolutionizing defense systems as well as cyber attacks.Capgemini polled executives who named AI and generative AI in cybersecurity as the leading trend among more than 60 tech trends for 2025. AI robotics is another space in full development, with cobots and AI robots making workplaces safer and more efficient. With robots taking on more autonomy and AI handling advanced decision-making functions, outdated workplace architecture can change. Quantum Computing Steps Closer to Practical Applications Quantum computing, which was once restricted to the boundaries of research laboratories, is now finding its way towards real-world applications. Q-CTRL, Australia’s first venture-capital-backed quantum technology company, is involved in addressing hardware errors and instability through quantum control infrastructure software. The number of searches for “Q-CTRL” has grown by 2,200% over the past five years, and the company closed a $27.4 million Series B in early 2023. With quantum computing technology advancing, sectors anticipate its influence. While challenges such as qubit stability and error correction persist, quantum computing can revolutionize fields such as cryptography, materials science, and drug discovery. Clean Energy Technologies Gain Momentum The international drive towards carbon neutrality has accelerated the development of clean energy technologies. Clean technology is receiving substantial investment and interest, with over 25% of venture capital going to cleantech firms. Investment and interest are fueled by the Inflation Reduction Act that offers loans, grants, and tax credits. Green hydrogen, being one of the clean energy sources with promise, is picking up steam. Made with renewable energy, green hydrogen registered a 1,000% increase in search volume over the last five years. Green hydrogen is expected to see demand growing at a CAGR of 61% by 2027 with a value of more than $7 billion. According to the Hydrogen Council, $700 billion worth of hydrogen-specific investment will be required by 2050 to reach net-zero emissions. Through May of 2022, a record 680 worldwide large-scale hydrogen projects were announced, a 160% increase over 2021. $47 million in clean hydrogen technology grants were awarded by the U.S. Department of Energy in early 2023. Plug Power, the largest U.S. maker of hydrogen fuel cell systems, began production at a plant in Slingerlands, New York, in 2022. Its stock price has increased by close to 30% after it entered into partnerships with TC Energy and Nikola. At the same time, Germany launched in September 2022 a hydrogen-powered passenger train which can travel more than 600 miles on a single refueling, and it can hit a speed of 86 mph. Germany aims to convert 2,500–3,000 of its trains to hydrogen fuel in the coming few years. Cloud Computing Continues to Expand The U.S. market is the dominant cloud market, with Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) collectively occupying about 68% of the global cloud infrastructure market. AWS accounts for 30%, Microsoft Azure 21%, and Google Cloud 12%. The European providers collectively hold only about 6% of the market. The U.S. cloud market is being fueled by the explosive growth of AI-driven cloud services, with cloud vendors increasing revenues as businesses invest in generative AI and related technologies. Market research indicates that demand for these premium services is driving double-digit year-over-year growth for the top three U.S. providers. Simultaneously, European providers are restrained by the rigorous data regulation, Digital Markets Act, and GDPR, rendering them less competitive and less capable of expanding. Europe is calculated to require trillions of dollars to be spent in infrastructure and talent at scale. The Rise of Small Modular Reactors (SMRs) With AI and other high-energy technology driving demand for clean, reliable power, nuclear energy is poised to take a front seat in 2025 and beyond. Small modular reactors (SMRs) will be making huge contributions in 2025 as an exciting solution for delivering the energy demands of the future. The Evolution of Supply Chains As a response to demanding and turbulent market conditions, businesses are prioritizing the circularity, resilience, agility, efficiency, and sustainability of their supply chains. Data analytics, AI, blockchain, IoT, and terrestrial-satellite network connectivity are all playing essential roles to enhance worldwide logistics. The future of the supply chain is becoming agile, greener, and AI-powered. Tech Layoffs and Reskilling The technology industry has seen mass layoffs in 2025, with over 28,000 U.S. tech workers being let go in Q1 alone. Google, Meta, and Microsoft have all reduced their workforce. Layoffs are being driven by overhearing in previous years, economic constraints, and the application of automation and AI. Many companies are concentrating on upskilling and reskilling workers for roles in cybersecurity, AI, and cloud computing. Regulatory and Trade Challenges The tech industry is under growing regulatory pressure. Google, for example, was found guilty of illegal monopolies in ad tech. U.S.-China export controls are tightening as well, impacting companies like Nvidia and AMD. U.S. export limits on advanced AI chips to China unsettled Nvidia’s business, and the company is anticipating a $5.5 billion charge this quarter on unsold H20 stock. AMD may incur up to $800 million in charges related to inventory and purchase commitments because of export controls. These regulatory actions have led companies to reassess their supply chain and inventory management strategies. Regional Market Developments U.S. The U.S. technology sector