There is a particular kind of investor who has done everything right on paper. They have diversified across asset classes. They have parked capital in...

We combine sector-specific funds (AI, ClimateTech) with hyperlocal market expertise across Singapore, India, and UAE. Our Evolution Pro framework accelerates scaling with regulatory navigation, talent sourcing, and cross-border expansion support – driving 40% faster growth than competitors in Southeast Asia's complex startup ecosystems.

We target AI/ML (35% of 2025 Asian VC deals), FinTech, HealthTech, and Sustainable Infrastructure. Focus includes India's SaaS innovation ($7.2B market), Singapore's Web3 hubs, and UAE's climate tech initiatives – prioritizing startups with scalable models in regulated industries.

70% of capital targets Singapore, India (Tier 1-3 cities), Malaysia, UAE (Dubai), UK, and USA. We leverage local teams for market insights: India's consumer tech boom, UAE's tax-free zones, and Singapore's deep tech corridor – ensuring compliance and rapid scaling.

We invest from Pre-Seed ($250K-$1M) to Series C ($5M-$20M), with 60% allocated to Seed/Series A. Focus on India/Southeast Asian startups showing 10% MoM revenue growth, proven unit economics, and capital-efficient scaling in high-potential tech sectors.

Yes, we lead 80% of initial rounds in portfolio companies, structuring founder-friendly term sheets with balanced governance. Specializing in cross-border syndicates, we connect Indian/Singaporean startups with UAE/US co-investors for follow-on funding at premium valuations.

Partners include ex-entrepreneurs from Grab, Paytm, and Careem with hyperlocal operational experience across 6 target markets. We provide hands-on scaling playbooks for India's consumer apps, UAE's fintech regulations, and Malaysia's manufacturing logistics.

Use our online portal for pitch decks. Required: financial projections, cap table, and market analysis. India/UAE-based startups receive feedback within 7 days. Priority for companies addressing ASEAN sustainability mandates or India's digital infrastructure gaps.

We prioritize: 1) TAM (Total Addressable Market) >$500M in target regions 2) IP defensibility 3) Unit economics 4) Founder-market fit 5) Regulatory compliance. Third-party audits validate claims, with AI tools accelerating India/Singapore market validation.

Term sheets issued in 2-3 weeks post-initial meeting. UAE/Singapore deals close fastest (25 days avg) due to streamlined regulations. Full due diligence takes 4-5 weeks with parallel legal/financial review for rapid deployment.

Target 15-25% for Seed ($1-3M checks) and 10-20% for Growth stages. UAE/India deals include board observer rights with founder-controlled governance. Structures align incentives through milestone-based tranches.

Yes, 40% of early-stage deals use SAFE (Simple Agreement for Future Equity) notes with valuation caps. Preferred for India/Singapore pre-revenue startups. Convertible notes include UAE-specific Sharia-compliance clauses where required.

Key red flags: weak unit economics (>12 mo CAC payback), fragmented cap tables, or non-compliance with India's DPDP (Digital Personal Data Protection) Act / UAE's ESG reporting requirements. Founders must demonstrate regional regulatory awareness.

Local teams navigate India's GST (Goods and Services Tax) systems, Singapore's PDPA (Personal Data Protection Act), and UAE's free zone regulations. We accelerate e-commerce licensing (e.g., India's ONDC integration) and fintech approvals in Malaysia – reducing setup time by 60%.

Yes, we deploy dedicated talent scouts across Bangalore, Singapore, and Dubai. Connect startups with executives from Flipkart, SEA Group, and Careem. Portfolio companies fill leadership roles 50% faster than market averages through our network.

Leverage partnerships with 30+ Fortune 500 corps (e.g., Tata Group in India, Emirates NBD in UAE). Run pilot programs with Singapore's Smart Nation initiative – driving 3x faster enterprise sales cycles for B2B SaaS startups.

Our finance team prepares Series A/B materials, introduces tier-1 VCs (e.g., Sequoia India, MEVP), and negotiates term sheets. Portfolio companies raise follow-on rounds at 2.3x higher valuations than regional benchmarks.

Custom GTM (Go-to-Market) playbooks for India's multilingual markets, UAE's high-net-worth client targeting, and SaaS metric dashboards. Startups improve gross margins by 25% through our unit economics optimization system.

We take 1 board seat with focus on strategic guidance – not daily operations. Quarterly KPI reviews track India/SEA-specific metrics like cohort retention and regulatory compliance scores. Founders retain 85% voting control.

Seed investments: 4-6x cash-on-cash returns in 5 years. Growth stage: 5-8x in 4-6 years. India/Singapore AI portfolios outperform at 7.2x avg. Returns enhanced through UAE/Singapore tax-efficient holding structures.

65% strategic acquisitions (e.g., Indian edtech to Byju's), 25% IPOs (targeting India's NSE/BSE), 10% secondary sales. UAE exits leverage Dubai's IPO accelerator program for 30% faster public listings.

Diversify across 6 geographies with sector caps. Use milestone-based funding tranches and 1x liquidation preferences. 20% allocation to lower-risk growth-stage startups in Singapore/Malaysia with positive EBITDA.

Fund VII (2024) shows 4.8x MOIC (Multiple on Invested Capital). India portfolios lead at 6.1x. Climate tech bets in UAE/Singapore project 35% IRR (Internal Rate of Return) via carbon credit monetization.

Hedge INR/USD and SGD/MYR volatility via forward contracts. Maintain 30% USD reserves for follow-ons. UAE investments use dirham-pegged structures to minimize forex exposure during exits.

Yes, we structure partial liquidity events at Series B+ (typically 10-15% stake). Enabled 8 India/UAE founders to unlock $2M-$15M pre-exit while retaining control through dual-class shares.

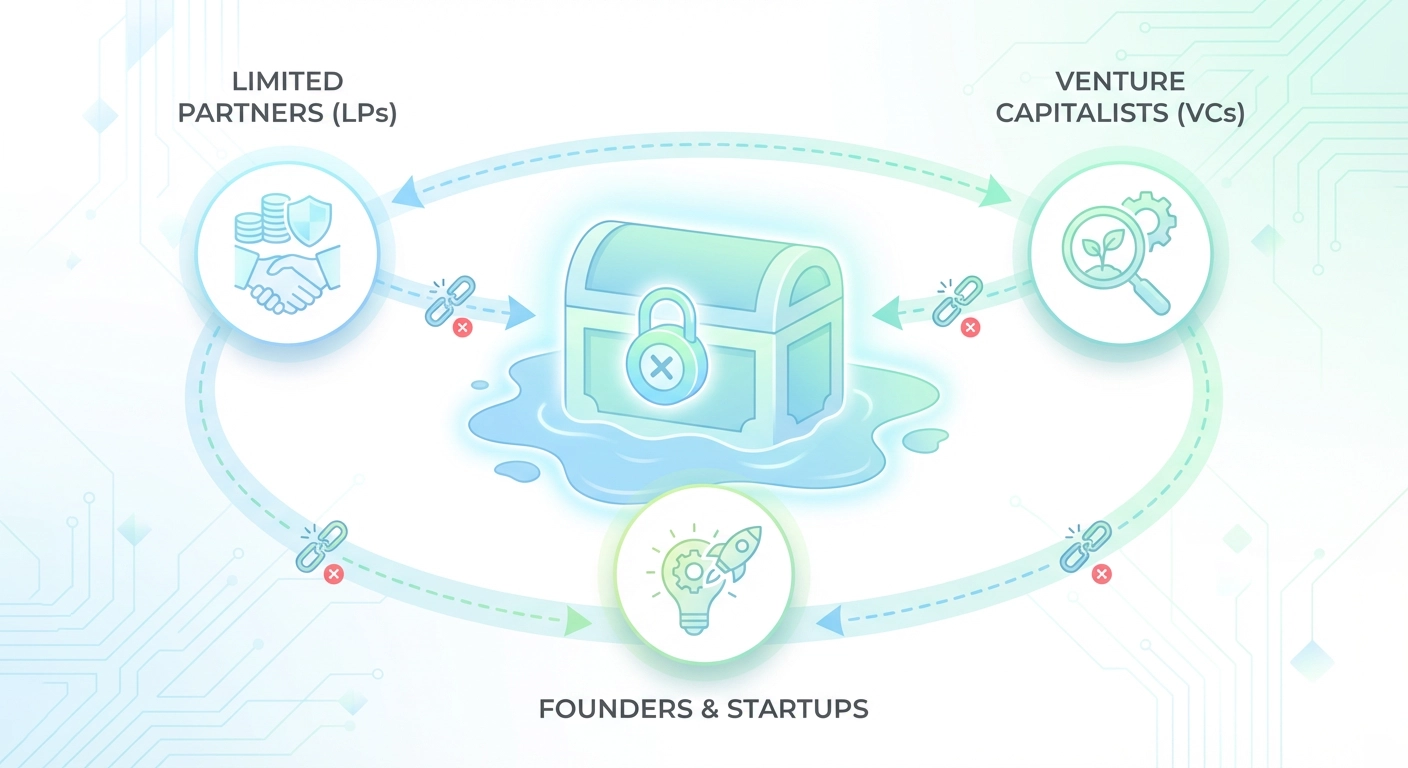

Accredited investors commit $250K+ via LP (Limited Partner) agreements. UAE/Singapore family offices access bespoke vehicles with quarterly distributions. Submit KYC (Know Your Customer) through our portal for fund docs and regional tax summaries.

Quarterly reports include TVPI (Total Value to Paid-In), DPI (Distributions to Paid-In), and regional performance breakdowns. Access real-time dashboards tracking India/UAE portfolio KPIs. Annual meetings in Dubai/Singapore with exit roadmaps.

Yes, our SPV (Special Purpose Vehicle) platform offers $100K+ co-investments in high-conviction deals. 2024 UAE/UK co-investors achieved 48% net IRR across climate tech and fintech deals.

Mandate SFDR (Sustainable Finance Disclosure Regulation) Article 8 reporting. Track gender parity (40%+ female execs in portfolio) and CO2 reduction metrics. 35% allocation to UAE/India climate tech meeting UN SDGs (Sustainable Development Goals).

$180M deployable capital: 40% India, 20% SEA, 15% UAE, 15% USA/UK. Prioritize Seed rounds ($1-3M checks) in AI/ClimateTech with 8-10 deals/quarter across target regions.

Our EVA (Evolve Vision Analytics) platform predicts liquidity events using India/UAE market data. Automates KPI tracking with 92% forecast accuracy for Series A readiness and exit timing.

Seek domain experts with 5+ years in regulated sectors (fintech, healthtech). Value resilience navigating India/ASEAN bureaucracies and cultural agility for cross-border scaling. 80% of funded founders have industry-specific exit experience.

Yes. Governance includes founder veto rights on key decisions, 4-year vesting schedules, and independent board seats. UAE/India deals feature enhanced founder protections via golden shares.

Provide access to IIT (Indian Institutes of Technology)/NUS (National University of Singapore) talent pipelines and Dubai's global tech expat network. Cover 50% of recruitment fees for CTO/CPO roles during scaling phases.

Yes. Secure India's RBI (Reserve Bank of India) fintech approvals, UAE's ADGM (Abu Dhabi Global Market) licenses, and Singapore's MAS (Monetary Authority of Singapore) exemptions – accelerating market entry by 4-9 months.

Monthly sessions with operating partners: Ex-Paytm CMO on India user growth, Careem alumni on MENA expansion, and Grab veterans on SEA logistics optimization. Custom playbooks for each market.

Proactive alignment via quarterly feedback sessions and independent advisory boards. Escalation path to neutral Singapore arbitration center. Zero forced founder replacements in 2023-2025 portfolio.

Explore our carefully curated investment opportunities designed to maximize returns, backed by strategic expertise, transparent insights, and personalized partnerships. Partner with us to elevate your portfolio and achieve sustainable growth.

Building long-term relationships with investors for tailored, impactful investment experiences.

Leveraging proven strategies and deep market insights to maximize your investment returns.

Providing regular updates, clear reports, and seamless communication to keep you informed.

Access carefully vetted ventures across diverse industries to elevate your portfolio.

There is a particular kind of investor who has done everything right on paper. They have diversified across asset classes. They have parked capital in...

A toxic complacency has formed within the boardrooms of Singapore, the skyscraper offices of Dubai, and the family offices of Palo Alto. Many sophisticated investors...

The technology industry’s crying relief has gone ‘awe inspiring’, having gone through the trials and tribulations of 2022 and 2023, the prevailing argument at present...

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Websites store cookies to enhance functionality and personalise your experience. You can manage your preferences, but blocking some cookies may impact site performance and services.

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Google Tag Manager simplifies the management of marketing tags on your website without code changes.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

You can find more information in our Cookie Policy and Privacy Policy.

WhatsApp us