A New Era of AI-Driven Economies

The global startup ecosystem is undergoing a powerful confluence of venture capital and artificial intelligence. Earlier this week, Dubai’s Crown Prince Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum unveiled a significant initiative related to artificial intelligence: a large AI platform, a task force, and a startup accelerator — demonstrating the UAE’s intention to lead a new phase of the digital economy.

This strategic effort, launched through the Dubai Centre for Artificial Intelligence, is meant to attract the best startups, innovators and researchers the world has to offer. It strives to establish Dubai as a global center of AI-enabled solutions, including funding, policy or infrastructure to construct scalable, future-ready businesses.

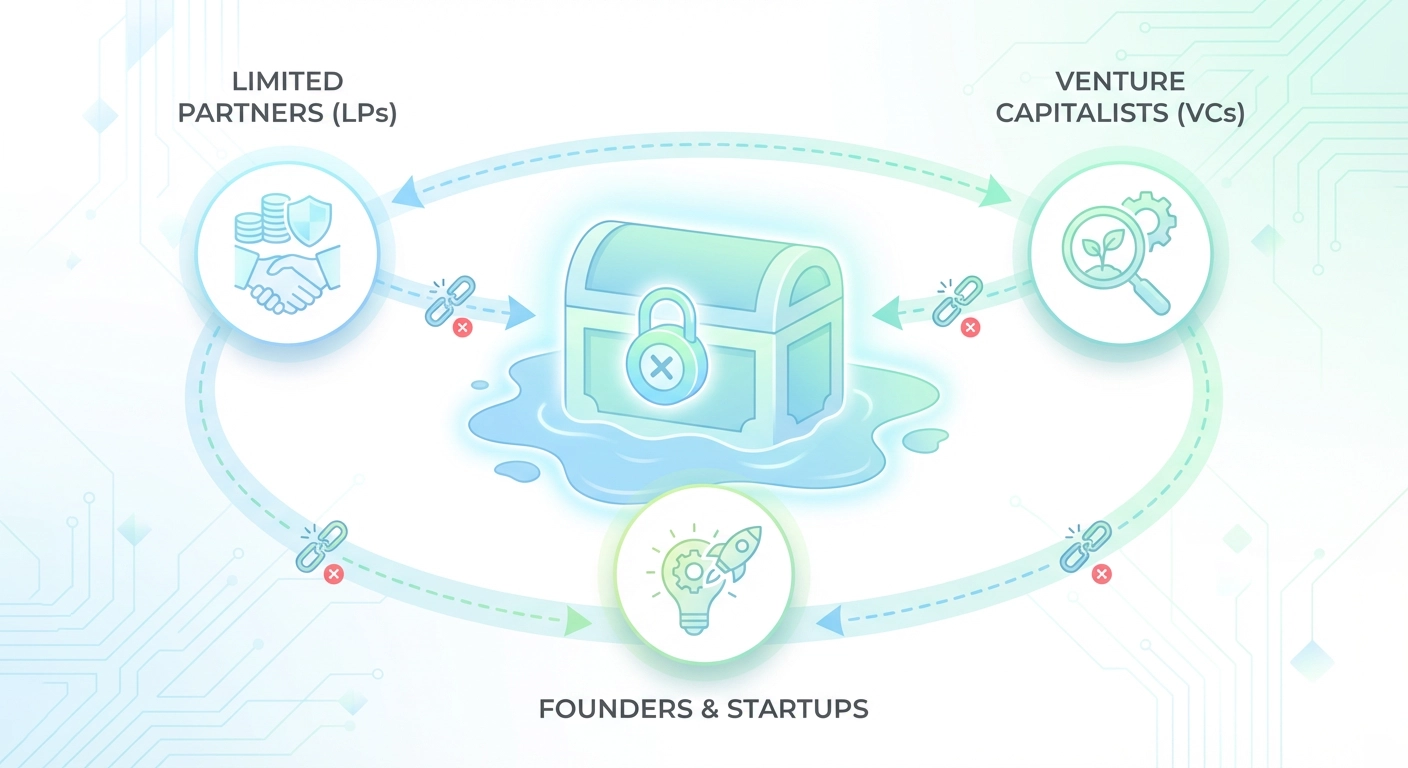

For global investors and VCs, this initiative presents a unique opportunity — not just in the Middle East, but as a heralding of a developing ecosystem for AI that is ready to receive early-stage capital.

“The UAE’s commitment to AI represents a shift in how nation states are competing for the leadership of innovation. It is no longer simply technology adoption. It is a primary ecosystem.”

— Evolve Venture Capital Research Desk

Diversis Capital Joins the Billion-Dollar Fund Club

At the same moment, elsewhere in the world, Diversis Capital has announced the close of its latest $1 billion fund, solidifying its place among the heavyweights of global private equity and venture funding.

The Los Angeles-based firm, a supporter of technology-driven mid-market companies, will focus on software, data platforms and tech-enabled services. The fact that the firm was able to raise a sizable capital is a further indication that there is faith in the resilience of the tech sector and more broadly suggests that institutional capital is still gravitating towards digital-first businesses, irrespective of macro conditions.

This shift adds to an interesting trend – a more thoughtful and ultimately specialization-focused capital allocation process where allocators will learn to prioritize greater depth over diversification.

Global Insight: Why This Matters for the Venture Ecosystem

Together, these developments bring clarity to the more global nature of the new productization cycles underpinned by both policy-driven innovation (Dubai) and expansion of private capital in new global markets (Diversis Capital).

Both reflect a larger global realignment in which public and private forces will converge to enable the next generation of startups.

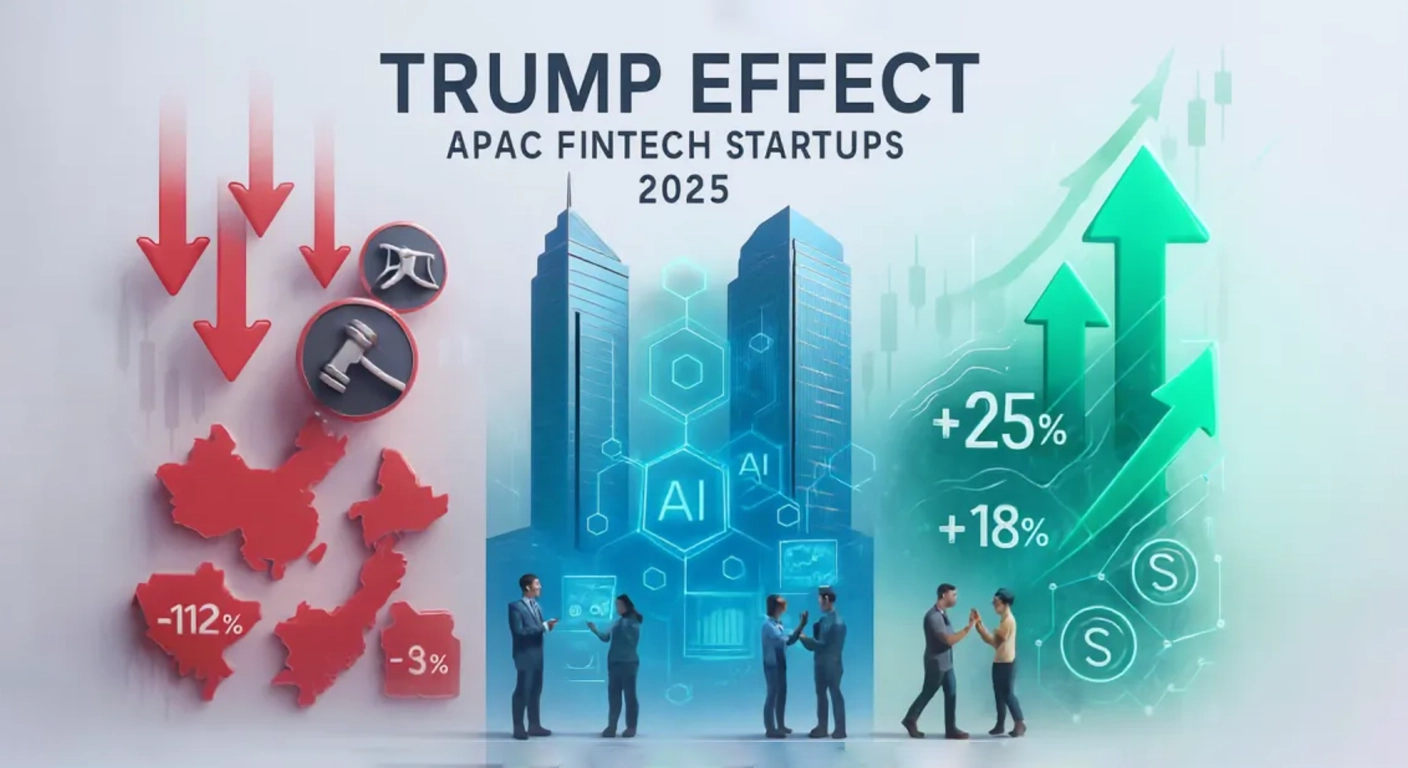

Startups in sectors such as AI, fintech, sustainability, and software as a service will likely benefit disproportionately from such a development. Venture capitalists should take note, engage with, and consider how to orient their existing portfolio – or reallocate capital altogether within growing sectors.

Evolve Venture Capital’s Perspective

At Evolve Venture Capital, we hold the view that the future of investment is all about connecting regions and industries — bringing together regions like the Middle East and Southeast Asia that are moving very fast with sophisticated global funds and innovation ecosystems.

We are focused on early-stage ventures taking technology to solve scalable global problems, specifically related to AI, sustainability, and digital transformation.

As businesses like Dubai emerge as a key global centre for innovation, and funds like Diversis Capital start to invest larger amounts of money, Evolve Venture Capital is there to help build the bridge between emerging ideas and global capital.

Sources: