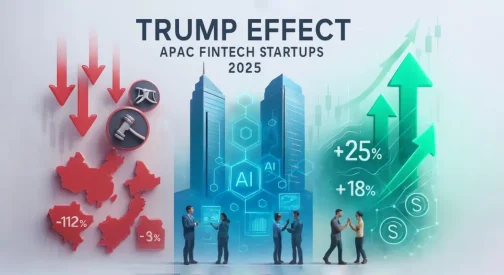

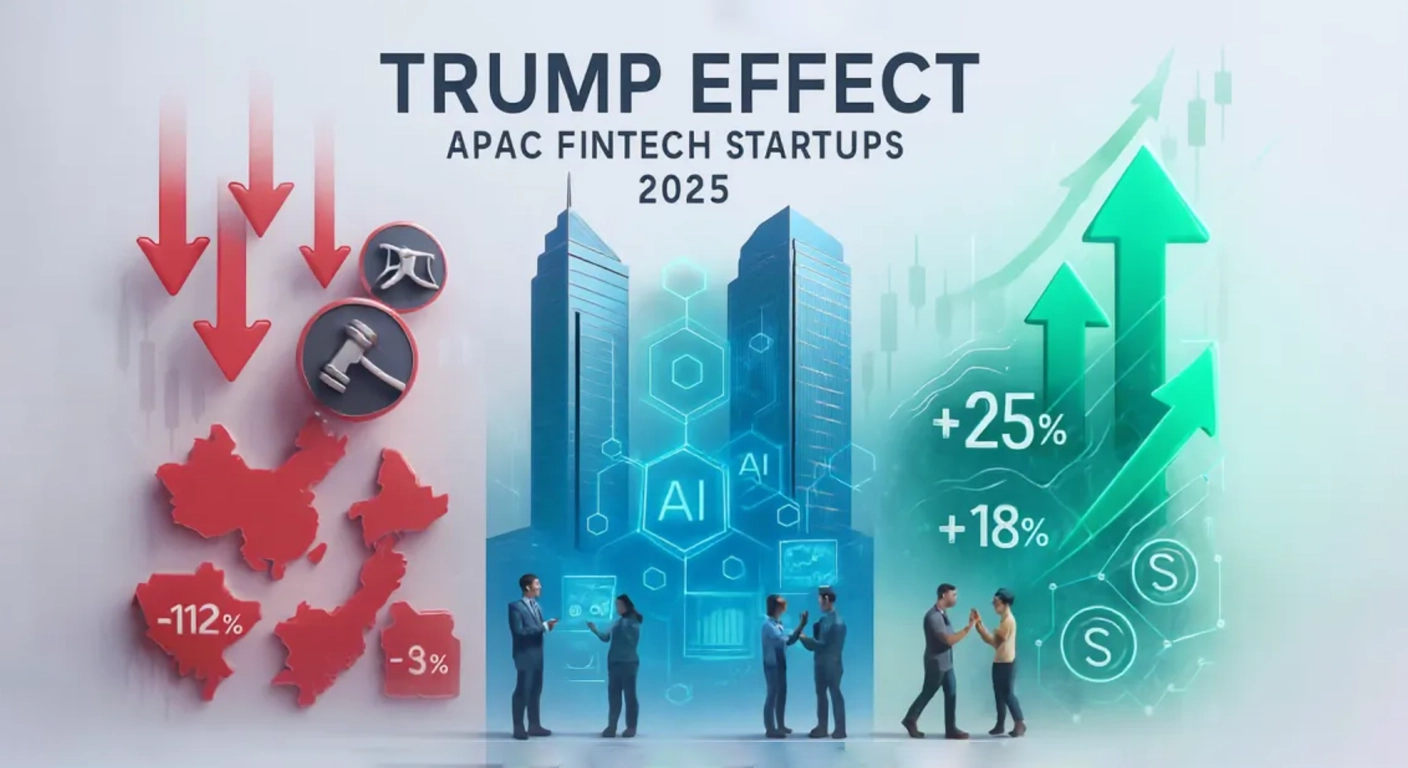

In Singapore’s fintech hub, where blockchain startups live harmoniously with digital banks, APAC (Asia Pacific) entrepreneurs have a brave new world in 2025. The so-called Trump Effect APAC Fintech 2025 – which consists of overly-aggressive tariffs (10% to 49% on 60+ nations including China and Vietnam), crypto-deregulatory policies, and trade primarily for America – has rattled many markets around the world. Across the APAC region, fintech funding fell 40% in Q2 2025 to $15 billion yet did secure over $11 billion in ‘deals’, and is clearly very resilient with sizable issues in India and Singapore. Tariffs have made cross-border payments more expensive, but the opportunities are rising in AI and finance use cases, DeFi (decentralized finance), and embedded finance. How can APAC fintechs convert trade wars into wins?

This blog looks at the effects of the so-called “Trump Effect” on the APAC fintech sector and tracks some APAC fintech trends such as AI bucketization, adoption of stable coins and what’s changed in cross regional trade. The blog is full of references to scrappy startups and statistics from the wild markets of 2025, and gives you some ideas on how to deal with Trump tariffs impact, how to use deregulation, and build scale in an ever more fragmented world, with the vision to build APAC into a fintech powerhouse by 2028.

1. Decoding the Trump Effect: Tariffs, Deregulation, and APAC’s Fintech Landscape

Tariffs Reshape Global Finance

The tariffs imposed around Trump’s “Liberation Day” — 10% on our allies and 49% on China i.e., were devastating to APAC fintech. Global VC funding reached $109 billion for Q2 2025, however the APAC share was down 40%, due to inflation from tariffs after investor confidence diminished. Vietnam has 46% duties on tech exports to the U.S., taking payment solutions along with it, while China’s semiconductors are down 15% YoY (down 16% according to our data). On a positive note, India’s fintechs received $2 billion in seed funding and Singapore’s digital banks increased to 25% from 4% adoption in 2022. [Source: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/fintech-funding-falls-in-2024-but-mega-rounds-show-tentative-signs-of-optimism-80359390]

Deregulation Sparks Crypto and Fintech Innovation

The effects of Trump’s repeal of Biden’s AI executive order and proposed elimination of the Consumer Financial Protection Bureau (CFPB) has opened up fintech innovation in the U.S. This fintech deregulation has also caused a 25% increase in crypto payments with $3 billion in stablecoin payments in 2025 for cross-border payments. That said, less guidance on anti-money laundering (AML) has created a 25% chance increase of fraud with scams in 2024 with deepfakes costing $12.5 billion. Fintechs in APAC would have to balance opportunities in the U.S. against complying with their local regulatory requirements including the Monetary Authority (MAS) AI governance in Singapore.

Currency Volatility and Trade Shifts

Meanwhile, the rise of the U.S. dollar (funded by tariffs on the rest of the world) depreciated APAC currencies like the Chinese yuan and Vietnamese dong with losses of about 5-8%. Fintechs are flourishing, including those with blockchain-based online tools that provide hedges, like currency swaps. DeFi has raised an estimated $2.1 billion in the 1st Quarter 2025. Intra-ASEAN traded 15% more, all of which give relief to fintechs as they can circumvent tariffs from the U.S. and regional trade deals like RCEP, and CPTPP provide lifeboats to extra-regional trade compliance.

2. Top Fintech Trends in APAC: Thriving Amid Trump’s Trade Policies

AI-Powered Personalization Redefines Finance

AI is sweeping across APAC fintech. By 2025, over 77% of consumers will be using AI driven banking services. Generative AI is driving chatbots that are already handling 60% of queries in Singapore banks. Similarly, predictive analytics cut down fraud by 25%. Because Trump’s tariffs on chips (25% on imports from Asia) made AI infrastructure costs 15% higher, it is also now pushing startups to use large language models (LLMs) both locally (India) and in Asia (China), where 60% of APK companies report using hybrid AI. Jakarta-based neobank, for example, was able to design and implement bespoke BNPL plans for gig workers by leveraging AI, resulting in a 40% increase in retention rates, despite tariffs forcing price increases. Over the next 4 years, AI in fintech APAC could save banks $1 trillion in competitive cost structures, with Singapore being an established global hub for fintech.

DeFi and Stablecoins: Tariff-Proof Growth

I mean, explicitly, the measures taken by the Trump administration such as Executive Order 14178 explaining the compliance cost of digital assets have led to the expansion of DeFi in Asia. The sum paid in stablecoins has grown ten times since 2020 to more than 3 billion dollars and Singapore has also hosted the largest fintech festival ever in the world. Loaning platforms on blockchains collected 2.1 billion in Q1 2025, even though trade had been affected by new tariffs. A Bangkok-based start-up stablecoin serving regional trade in the ASEAN area reduced cross-border transactions by 30 percent, implying that we are entering the age of tokenization. This is a milestone of stablecoin adoption 2025 with tokenized assets expected to reach 20% of payments in APAC by 2028.

Embedded Finance: Capturing Niche Markets

Embedded finance, which is the provision of financial services through a non-financial platform, is on the increase in APAC. Embedded finance (via apps like Gojek) in the gig economy in Indonesia had a 50% adoption rate despite Trump tariffs driving up the cost of logistics (with 12% in export drop in Vietnam). Embedded finance has a huge potential as only 3 percent of banking revenue has been tapped. Embedded finance delivered a 35 percent jump in revenue based on monthly average business volume on a Malaysian e-com platform that embedded BNPL in hospitality. By 2026, embedded finance has the potential to generate 10 percent of SEA retail revenue, where ASEAN is expected to be a digital economy leader.

Cross-Border Payments: RCEP as a Lifeline

Payments between the US and APEC have been held up by tariffs, which have attached 46 per cent duty on Vietnamese technology exports. On a positive note, RCEP has pushed intra-regional payments up 20%. A startup in Singapore has created a blockchain-powered remittance platform that reduced the cost of sending money between Japan and the Philippines by 40 percent. The cross border payment market in APAC is expected to grow to over half a trillion by 2027 as fintechs use regional trade agreements to circumvent the U.S. limitations.

3. Challenges in the Trump Era: Navigating Fintech’s New Normal

Rising Costs from Tariffs

Here, operation costs have been increased by 15 percent tariffs in data center costs combined with chip tariffs. The tariffs have also compelled the APAC fintechs to relocate to the local data centers. A payment startup based in Vietnam moved out of US datacenters to Singapore and saved 25% of their costs.

Fraud Risks in a Deregulated U.S.

Trump’s reduced AML regulation will likely allow fraud to surge 25%, and deepfake attempts surged +194% YoY in APAC. Fintechs have to invest in AI-powered fraud detection. One Malaysian startup used liveness technology to reduce synthetic fraud exposure by 30%.

.

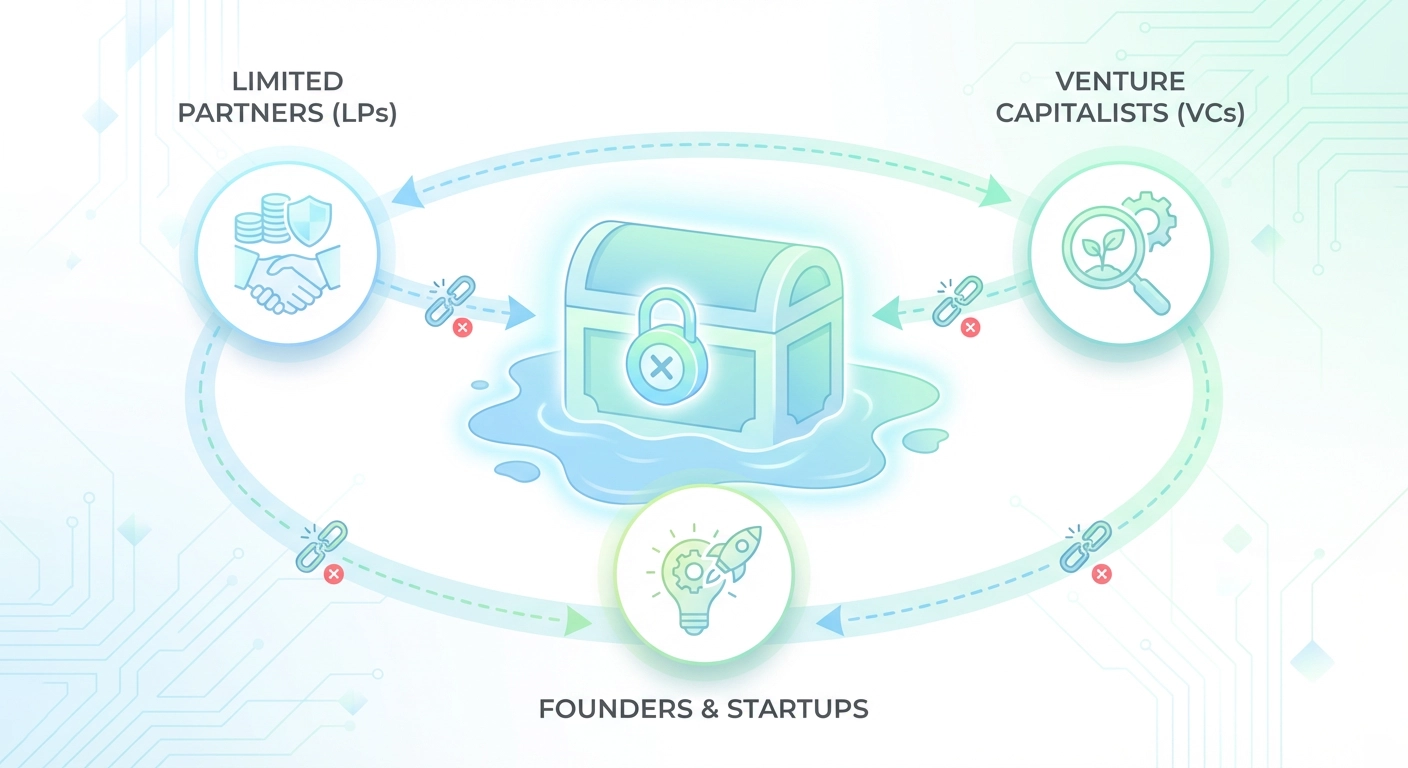

Valuation and Funding Pressures

In 2025, fintech valuations took a dive of 41.2% whilst APAC’s seed squeeze continued. Strong unit economics (LTV/CAC >5) are now essential. Investors are pivoting to ASEAN-focused deals.

4. Strategies for APAC Fintech Success in 2025

-

- Pivot to Regional Markets: Use RCEP/CPTPP to bypass U.S. tariffs, focusing on intra-ASEAN trade (up 15%). A Philippines-based DeFi platform targeted Japan, raising $8M by showcasing tariff-free payment rails.

-

- Invest in AI Fraud Detection: Counter deepfake risks (207% fraud spike in Singapore) with tools like liveness checks and behavioral analytics, cutting losses 30%.

-

- Leverage Stablecoin Opportunities: Trump’s crypto policies (e.g., GENIUS Act) make stablecoins viable for cross-border payments. A Singapore startup’s ASEAN-focused stablecoin cut costs 40%, attracting $10M in funding.

-

- Optimize Unit Economics: Pitch decks emphasizing LTV/CAC >5 and tariff-proof models secure larger rounds. An Indian wealthtech startup raised $12M by showcasing AI-driven portfolio optimization.

-

- Build Regional Partnerships: Collaborate with APAC banks (e.g., DBS, UOB) for embedded finance, as seen in a Malaysian platform’s 35% revenue boost via hospitality BNPL.

5. The Future of APAC Fintech: A Tariff-Proof Horizon

Overall, AI, DeFi, and embedded finance allow APAC fintechs to achieve 15% of all worldwide banking revenue (1.5 trillion) by 2028. The fact that Singapore is a technology hub and India is experiencing an increase in seed funding is an affirmation of momentum. Expect unicorns in SEA to increase by 80 by 2026. RCEP will start to remove tariffs, and the cross-border payments market is expected to reach $500 billion.

This future demands strategic partners. Evolve Venture Capital (www.evolvevcap.com) is that partner, empowering APAC fintechs with Startup Acceleration to pivot markets, Investor Excellence to secure cross-border capital, and community forums to navigate regulations. From mentoring a Thai DeFi startup to funding an Indian wealthtech disruptor, Evolve Venture Capital bridges vision and victory. Its Global Network Access connects founders with U.S. and ASEAN investors, while Pitch Deck Assistance crafts narratives that win $10M+ rounds. In 2025’s tariff-laden world, Evolve Venture Capital transforms challenges into opportunities, positioning APAC fintechs to redefine finance.

Ready to conquer the Trump Effect? Visit www.evolvevcap.com to join a community driving fintech’s future. Let’s shape a tariff-proof 2025 together.