Hey investor! If you’re here, you’re probably looking to find ways to make your money work harder. You most likely have a great portfolio, likely a mix of stocks, real estate, or even some riskier investments in startups. But let’s be real, the investing landscape today is like trying to navigate through a labyrinth in the dark. New opportunities pop up all the time, markets change on a dime, and figuring out where to put your money can feel like a poker hand. That’s why we’re going to discuss how intelligent investors are changing their investment strategies and why you should consider a partnership with Evolve Venture Capital. Let’s go! This is going to be fun!

The Investor’s Puzzle: Too Much Noise, Not Enough Signal

Let’s say you at your desk, coffee in hand and scrolling your news app. One headline announces a new AI startup that is “changing the world.” Another announcement tips off a massive tech bubble. Ping, in your inbox is a pitch deck from the founder of a startup declaring they will be the next big thing. Meanwhile, your buddy from the golf course will not stop talking about the next big crypto opportunity. It’s infinite and exhausting. Too much information and opportunities can overwhelm even the best investors.

But it is worse than just determining the best investment opportunity. You have to consider what investment opportunities align with your goals for returns, risk tolerance, and timing. Should you invest in the green energy startup, hold off on unstable growth, play it safe with dividend stocks, or become a limited partner in private equity? Without clear objectives, you will consistently guess—and be in fear, and second guess—every decision. And the time spent researching each opportunity? Yeah, that’s hours you can NEVER get back.

This is where a lot of investors get stuck. They have the money and the drive, but the complexity of today’s markets benefits them little in getting ahead of the game. This is another reason why more people are rethinking how they invest; unfortunately for investors but best for researchers, figuring out what really matters is incredibly complex.

The New Playbook for Smart Investing

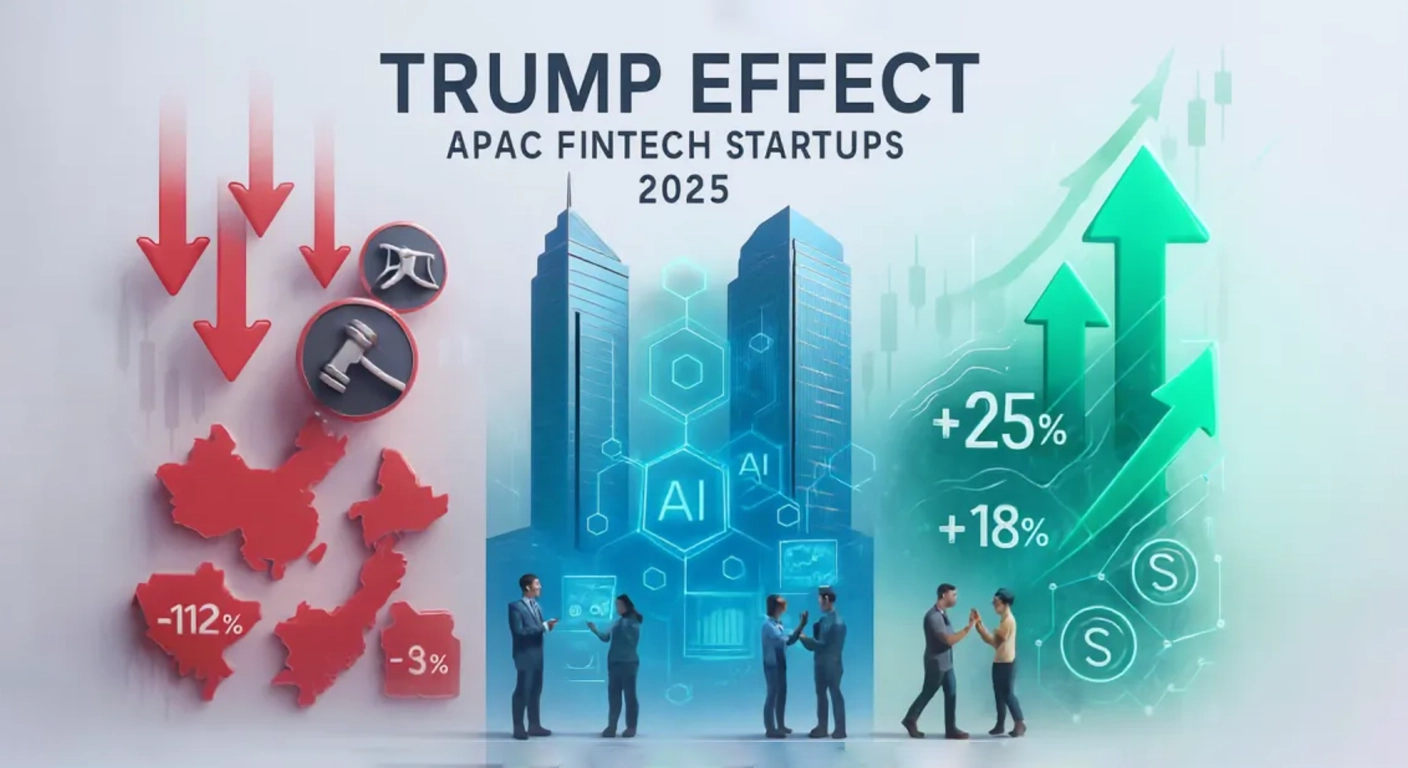

So what’s going on? First, the investment game has changed. The good old days of simply investing in index funds and waiting for retirement are over. Today’s markets involve innovation; biotech, blockchain, sustainable technology. Venture capital has never been so popular and according to a 2023 report from CB Insights, over $350 billion was invested globally in what people have been referring to as “cutting-edge” startups last year. It’s an exciting time but a time where we have to be quick and smart.

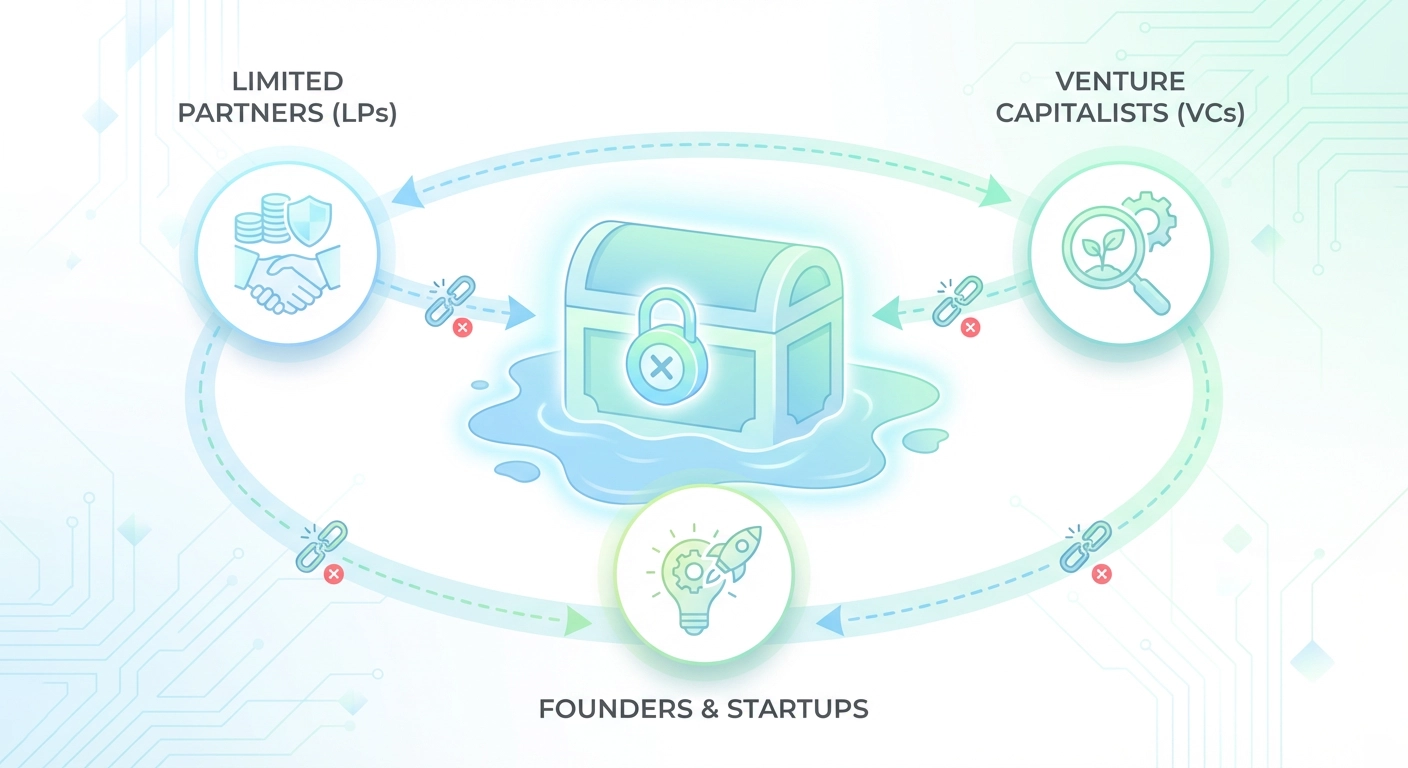

One of the major shifts we are seeing is the alternative investment space. Whether looking at venture capital, private equity, or various niche areas like impact investing are taking people’s attention. Why? Because they can generate returns that traditional markets often cannot approach. There is a catch though – these type of transactions are more difficult to navigate. They can be less liquid, require deeper analysis, and often require certain insider knowledge to be able to know which are good ones. This is why investors are often partnering with professionals who can navigate the nuances for them.

Another area worth discussing is how easily investors are able to access deals now. Technology has allowed investors to invest in startup businesses and projects that were previously only accessible to a very wealthy audience. There are now many new avenues for investing through angel networks and crowdfunding sites. With the accessibility has also come a ton of options, with potentially hundreds of start-up businesses competing for your attention. It is a full-time job to sort through them to find the good ones. And, this is therefore before you add in the requirements for due diligence, and market research, and potential exit planning, having you potentially spending more time dealing with the paperwork if you are using your own research rather than just the access opportunities. Therefore it is completely understandable investors want a better way.

Why Flying Solo Might Hold You Back

Let’s talk about going solo. Certainly, many investors enjoy the thrill of running down deals and making instinctual decisions. Alumni love the adventure, and there is nothing wrong with that—your instincts have served you well. All I’m saying is that, even the best hunters use guides when exploring unfamiliar territory. No one can know everything about every industry or startup, and although you may be incredibly knowledgeable, going too alone may cause you to miss breath-taking opportunities.

Take the following for example: you are renovating your home—would you try to renovate without a contractor? No, you would choose a contractor that had the knowledge and tools to do it correctly. Investing is no different. By partnering with a firm with venture capital as their Passport to Success, you are getting the information, social capital, and deals that you may not have found on your own. Further, you can keep your eyes on the prize out there—whether that is to scale your business, determine your next plans, or just relaxing with your family.

Why Venture Capital Is the Place to Be

Now, let’s focus on venture capital. It’s seriously one of the most exciting places for investors right now. There is no better experience than when you invest in an early-stage company. You are not just buying shares; you are a part of building the future! Whether it is a startup changing the dynamics of healthcare, developing the next “need to have” app, or attempting to mitigate climate change, you literally start from the ground floor. There is nothing better than being part of that!

However, venture capital is not easy! For every company that hits it big, there are many, many more that fail. The problem is knowing how to identify the winners. To do this, you will need to know how to research, have industry knowledge, and back founders that have the vision and ambition to deliver on their ideas and make it happen.

What Makes Evolve Venture Capital Your Secret Weapon?

So, why Evolve? We are Evolve Venture Capital, and we help investors like you maximize their capital. We do not have one-size-fits – all portfolio solutions and we do not try to sell or coerce you into deals that don’t feel right to you. We want to help you strategize your investments according to your specific goals, even if that means you want to maximize growth, diversify your investments, or support companies that have an impact.

Here are a few things that differentiate us:

1. Handpicked Opportunities

We know your time is valuable, and we don’t waste your time with pitch after pitch after pitch whenever a pitch ends up in our inbox. Our curation process involves thorough screening of all startups after analyzing their business model, market, and team. The deals that you receive from us represent real opportunity, and are tailored to your individual interests and preferences on risk.

2. Industry Know-How

We have the collective experience to know what’s next, in product categories ranging from AI to clean tech to fintech. We have real experiences that demonstrate what it takes to make a startup successful and are committed to sharing the insights learned (beyond the buzzwords).

3. Active Support for Startups

When we invest in a company, it isn’t a cash hand-off, where we walk away. Instead, we work closely with the founders and the rest of the teams, advising them, introducing them to new people, helping them navigate the bumps along the way, and more. This hands-on approach increases the odds of success for the companies you invest in.

4. A Network That Delivers

Investing is more about who you know than it is about what you know. Our relationships with founders, industry veterans and other investors give us access to equity deals that others simply cannot get, access to the inside scoop on companies that we are looking at investing in, and an opportunity to co-invest alongside other top investors and being invited to events that others cannot attend.

5. Straight Talk

We are very clear and honest. No jargon and no hidden stipulations. We will walk you through opportunities, highlighting the pros and cons while making sure you have the appropriate level of conviction. Your success is our success and we are in for the long haul.

Winning with Evolve: What It Looks Like

Wondering what it might be like to invest through Evolve? Picture this: A successful investor with a background in stocks, bonds, and real estate looking to experience something different through venture capital. They’re excited about the potential of innovation but scared off by the onslaught of startups. With Evolve, the investor will be presented with opportunities, and we will have already done the hard work for you: lets say a promising edtech startup led by a great team. Fast-forward one year, and that startup raises a financing round and now the investment looks great.

Or imagine a business owner who has successfully sold the company they built who is looking to reinvest their capital. They’re interested in biotechnologies, but feel apprehensive due to the risk profile. We help navigate the venture capital process, we share our insights, and we connect them to a startup developing a revolutionary medical diagnostics test. Before long, they are starting to see positive returns, but more importantly, they have taken a keen interest in part of the economy that is working on solving problems and saving lives.

These are the types of outcomes we create for our investors. Through our research, our experience, and our hands-on-network and relationship-based approach, we make possibilities real.

Why Now Is Your Moment to Jump In

Timing is everything when it comes to investing, and right now, we are in the middle of a startup frenzy. There are amazing companies being launched every day in areas from AI to renewable energy. In a Pitch Book analysis, early stage investments are hotter than they have ever been with professional investors collecting big dollars by getting it early. These startups are hungry for capital, and you can cash in on the action by investing, and could make a serious payday later.

You are not in this alone and with Evolve Venture Capital as your partner, we will help you navigate this fast-moving world. Let us do the legwork and make the due diligence and management decisions while you concentrate on what you do best.

How Evolve Venture Capital Sets You Up for Success

Ready to see how Evolve can help you win? Here’s what we bring to the table:

- Personalized Game Plan: We determine what you—your goals, your tolerance for risk, your interests. Then we put together a plan that is all you, whether you are chasing high returns, or building separate baskets.

- Exclusive Access: Our network provides access to deals that are not publicly listed, from seeds to accelerators.

- Total Support: We do the heavy lifting from underwriting, to exit planning, so you can keep your eye on the prize.

- Transparent Intelligence: If you’re stuck on a deal or not familiar with an industry we will breakdown each aspect of the deal so you can make an informed decision.

- Accountable Partnership: We won’t just give you advice—we will be your partner. We are not engaged unless we are riveted to your success, every step of the way with transparency and honesty.

Let’s Make It Happen

If you’re ready to step your investments up & capitalize on the rise of venture capital…let’s talk. At Evolve Venture Capital, we help investors like you capitalize on opportunity, if you’re a seasoned or new investor in startups we have what you need to maximize your success.

Don’t let today’s fast moving markets slow you down. Let’s create a portfolio that excites you and possibilities. Visit www.evolvevcap.com for details or drop us a message. There is a next opportunity—let’s go find it!