A toxic complacency has formed within the boardrooms of Singapore, the skyscraper offices of Dubai, and the family offices of Palo Alto. Many sophisticated investors feel safe and secure they have gotten through the storm. On their diversified portfolios, they see large paper gains on their 2021 vintages and assume they are one to two IPO windows away from a recovery.

Nevertheless, a rot is festering underneath the surface of the ledger. If you are waiting for public markets to validate your private holdings, you are not being prudent, you are just a spectator in a game, with rules that were changed while you were asleep. The traditional venture capital firm model of “buy, hold and hope for a 100X unicorn” has died. The approach from here on out is brutal, cash-first, and the only metric that counts is Distributions to Paid-In Capital (DPI).

If your current investment partners discuss Total Value (TVPI) instead of Returned Cash (DPI), they are not protecting your capital but rather hiding behind a curtain of illiquidity.

The Vanity of the "Unrealized" Billionaire

36-month path to a strategic exit.

The Secondary Market: Where the "Smart Money" is Buying Your Stress

Right now, there is an enormous background wealth transfer taking place. Due to the fact that many institutional investors have remained over-leveraged despite being “asset-rich” they are “cash-poor” and are compelled to sell high-quality startup interests on the secondary market.

We see secondary market discounts as profound as 35% – 45% for top-tier, revenue-generating companies. While the “herd” waits for the IPO window to reopen in the USA, the most sophisticated investors are leveraging these secondaries to “skip the J-curve“. They are buying proven winners at the price of a seed round.

If you aren’t positioned to take advantage of this liquidity trap, you’re the one providing the discount to someone else. A proactive venture capital firm doesn’t just wait for an exit; they manufacture liquidity by navigating these secondary waters and make sure their LP’s are on the buying side of the discount, not the selling side.

The Denominator Effect: Why Your Asset Allocation is a Lie

Family offices and high-net-worth individuals believe they are “Balanced“. But with the fluctuation in public equities, the proportion of assets held in the very illiquid private equity asset class has ballooned—sometimes well outside the original mandate. This is the Denominator Effect.

When you are over-committed to illiquid assets, you will miss the opportunity to act on the “deal of the decade“. You will be a prisoner of your own portfolio. It is not necessary that we should stop venture capital investing in early stage startups, but we have to change the pattern of investment.

You require startup funding solutions that weave together the concept of “structured exits“—milestone investments that generate liquidity to get back part of the principal capital before the eventual exit. That is how you preserve your “liquidity buffer” with the asymmetrical gains that only private markets can offer.

The Fallacy of Silicon Valley Exceptionalism

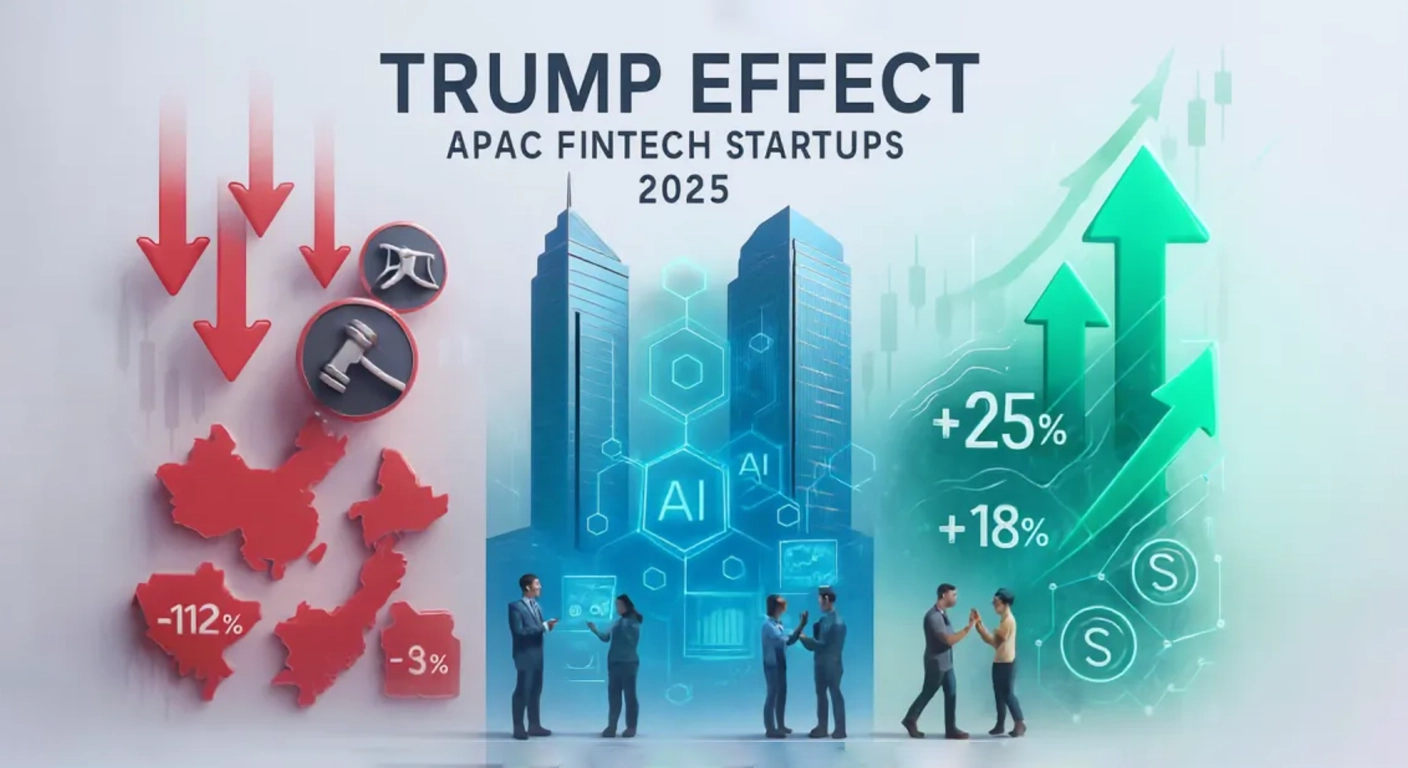

For decades, the “smart money” bet was following the Sand Hill Road playbook. But the world has decentralized. The future of the venture capital firm understands that the most resilient capital investment opportunities are now found at the intersection of Singapore’s regulatory clarity, Dubai’s capital influx, and India’s engineering scale.

In those regions, there is a degree of capital efficiency that is simply embarrassing to the traditional Western “burn-heavy” approach to entrepreneurship and startup investments. Startups in those regions are achieving profitability with only 1/10th of the capital typically invested in Western startup investments. The “margin of safety” for your investments in those regions is simply higher because those regions are not burdened with “Bay Area Tax”.

In sticking strictly to known geographies, you’re essentially paying a premium for a name, rather than for its performance. The true alpha in 2026 is in cross-border venture capital, where one can arbitrage the value of talent in a given place and the spending power of another.

Why "Diversification" is Often Just "Diluted Returns"

We frequently find ourselves mentoring investors who are spread across 15 different funds, thinking they’re “hedged“. In reality, they’re often holding the same 20 “hot” AI startups across all 15 funds. They haven’t diversified; they’ve just paid 15 different sets of management fees for the same exposure.

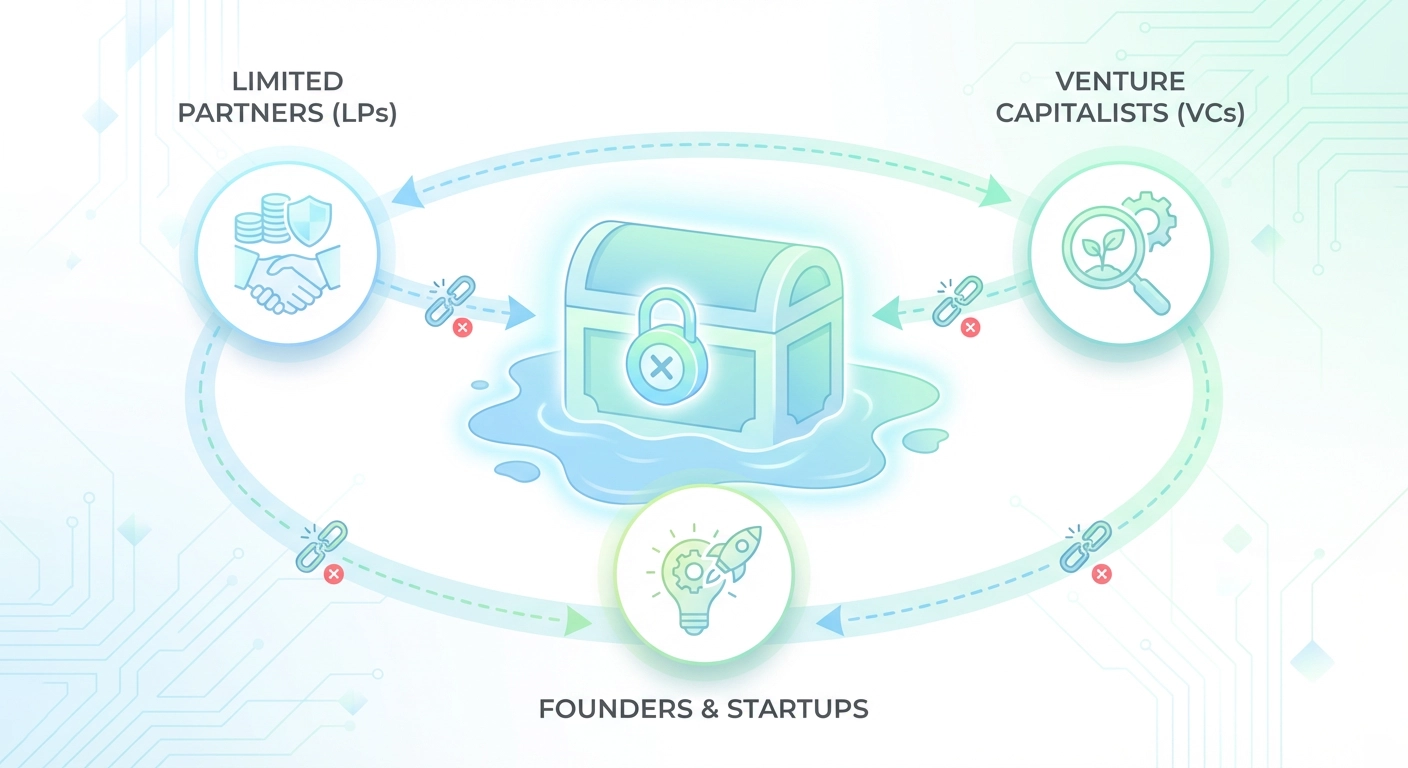

In the context of a venture capital firm, actual diversification means diversifying the nature of the risk. It involves being exposed to seed-stage moonshots countered by Series B secondary interests and revenue-based financing components. This leads to a “laddered” return profile where cash is consistently recurring in the portfolio rather than sitting locked away in a ten-year vault.

The "Safe" Way to Lose a Legacy

There is no greater risk than the slow erosion of relevance. Many investors find themselves “playing it safe” by holding cash. In the world of Agentic AI and industrious shifts, cash is a melting ice cube. “The winners of the next decade”, the companies being funded today, “are being funded at the lowest valuations since 2013”.

If you miss this investment options window due to “market volatility“, you’re not being a smart manager of your resources. Rather, you’re delegating your responsibility to increase those resources. The smartest people make their fortunes in the period between a “hype cycle” and a “utility cycle“. We’re living this transition phase.

The Art of the "Un-Fundable" Winner

We at the venture capital firm identify the companies that the more conventional, bureaucratic funds miss. These projects correspond to the “un-sexy” i.e, the B2B infrastructure, supply chain, and fintech middleware spaces. They’re not newsworthy ventures, but they generate DPI.

While others are racing to invest in the potential next Google among the AI companies, which may constitute just about one percent, wise investors should rather invest in the early-stage startups that offer the “shovels” for the AI gold-rush mine. Their businesses are characterized by high Net Dollar Retention (NDR) and low churn, which are the two factors that strategic acquirers would be keen to invest in in the year 2026.

The Startup Mentorship Program: A Fiduciary Necessity

Among the greatest “pain points” for investors is a serious feeling of loss of control once the check has been signed. You’ll be at the mercy of the execution by the founder. This is why a startup mentorship program isn’t a “nice-to-have“, it’s a tool that mitigates risks.

If a fund doesn’t actively move the needle for its portfolio companies, it is no more than a bank. And trust me, in 2026, you don’t need a bank, you need a Business Development Engine. You need somebody who can open doors for your US-based SaaS companies in the Middle East or navigate those pesky regulatory hurdles in India on behalf of your Singaporean fintech. This “Active Management” is what separates the top quartile venture capital firm from the rest.

The Reverse Psychology of the "Exit"

Everybody speaks about “How to get in“. Nobody speaks about “How to get out“. The best investors start with the exit. Before a single dollar is deployed, you must be able to name the five likely acquirers and the specific EBITDA multiples they are currently paying.

If a startup funding solution does not have an “Exit-First Architecture“, then it is fundamentally flawed. We believe in creating companies that are “bought, not sold“. This requires a rigorous focus on Governance, Compliance, and M&A Standards right from day one. A company that is built right from its private stages with the discipline of a public company makes sure that the “liquidity event” becomes an inevitability, not a hope.

Evolve Venture Capital: The Architecture of Realized Returns

At Evolve Venture Capital, we not only manage capital, but we manage the velocity of liquidity. It’s been said that, from an investment perspective, a “WIN” is not actually a win until the cash hits the ledger.

With our reach stretching from Singapore to India to Dubai to the USA, we are able to play within the ‘Flow’ of the world’s capital. We don’t simply follow the markets—we prepare for the rough spots that present opportunity. This could be from our venture capital investing in early stage startups to our strategic capital investment opportunities within the secondary market—we are single-minded DPI above all else.

We offer far more than funding. We also offer a startup mentorship program that turns founders into CEOs and “projects” into “exits“. We fill in the space between vision and visceral, to create an investment portfolio that is not just a set of logos, but also a high-performance machine of wealth creation.

Your legacy cannot be founded on “unrealized” gains. The time has come for you to adapt to changing market conditions in line with reality in the 2026 market.

Join the Discussion. Secure Your Liquidity. Evolve Your Portfolio.

Website: www.evolvevcap.com

Email: contact@evolvevcap.com

WhatsApp: +65 8181 4097

Global Presence: Singapore | India | Dubai | USA