The technology public markets have risen dramatically driven by a few select mega-cap technology shares.

You can hear the phrase “soft landing” on nearly every business news network across the globe. Entrepreneurs are again attracting high valuations due to the large amounts of capital that are freely flowing into AI. Prices have risen, with many heads of established venture capital firm publicly stating that their corrections have been executed, and the time to go back into the business growth mode has returned. However, it is prudent to say that the incoming optimism is prematurely misguided. At Evolve Venture Capital, we have a very different view of the current market. The optimism we see today is not representative of the recovery; it is, in fact, indicative of a dangerous turning point for the market as it relates to the private market – the core of what brings value – has still not changed fundamentally at all. The ‘pre-mature’ celebrations and optimism are not grounded in the most significant, contrarian indicator of all; The “Distressed Discount in the Secondary Market for Private Fund Interests.”

The Great Market Deception: Why Your Portfolio's "Recovery" is a Lie

There is no question; the venture market has developed perfect techniques for creating illusions. Redeemed or recovered markets are not based upon full market data but on filtered data. The huge increases in the S&P 500 and NASDAQ indexes we see are the results of the large AI focused “Magnificent seven” publicly traded companies. This illusion creates a “denominator effect” on the limited partners’ portfolios, and so their investments in public companies have recovered, but their private equity investments show that they are recovering almost entirely at an exaggerated value.

Real problems exist in the thousands of established private equity funds which are holding illiquid assets. This is where we discover the truth about the current bear market.

The Hidden Indicator: Secondary Market Pricing for LP Interests

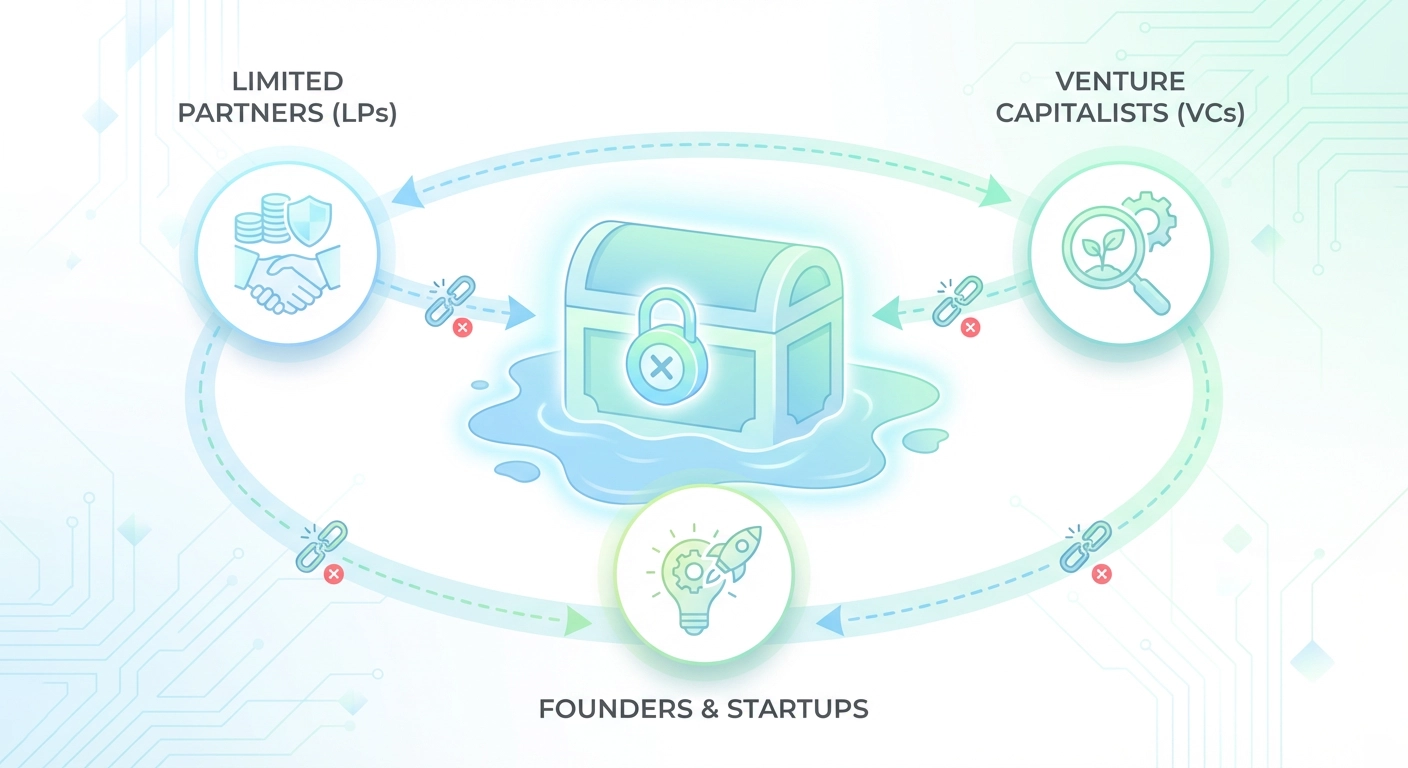

To gain an accurate understanding of how well a venture capital firm has managed its assets, you shouldn’t rely on quarterly letters from the firm. Rather, you should analyze how much value informed buyers are willing to pay for those assets when they are being sold under pressure which will give you a better indication of the health of your investment. The best indicator of market confidence can be found in the Venture Capital Secondary market investment where interested limited partners (LPs) sell their interests to other professional investors.

The Data Nobody Wants to Talk About: A 35% Discount to Reality

- In the current marketplace, discounts to the NAV are significantly higher than they were a few years ago. As a result of the discounts being offered by buyers of LP interests, some LP interests can trade at discounts as high as 20% to 35% to the most recent NAV on average for all non-top-tier funds. For most distressed situations, discounts exceed 40%.

- In contrast to non-top-tier funds, secondary buyers of LP interests are demonstrating that they lack confidence in the value of the VC fund’s NAV calculations. When they purchase LP interests at such steep discounts, they are expecting that many venture capital firm will have much lower NAVs in the near future than the value currently being reported by the VC firm. The value the investor receives when they purchase an LP interest in a VC fund will be based predominantly on the current market value of that LP interest; therefore, the LP will receive a higher percentage of the total assets in the VC fund.

The Liquidity Trap: Your Capital is Locked Up (And Why)

The current state of the secondary markets indicates that there currently exists a significant liquidity trap for every participant. As an investor, your money is tied up longer than anticipated. As a founder, you have less ability to raise your next round than you once did.

1. For Limited Partners (LPs): The Frozen Firehose

Today the number one challenge for LPs is not poor performance; it’s illiquidity. Successful technology companies are taking, on average, 12 years to be successful and distribute returns. When fund distributions stall, LPs are confronted with two key challenges:

- Over-allocation – There is an excessive amount of private assets, which means LPs may be forced to sell a good stake in a fund just to be able to maintain a more balanced portfolio.

- Demand for transparency. Don’t trust reported NAV at face value. Only commit to a new venture capital firm with a solid track record for producing returns, (not just paper returns). Always ask for DPI (Distributions to Paid-In Capital) instead of TVPI (Total Value to Paid-In Capital). DPI is cash; TVPI is an IOU.

2. For General Partners (VCs): The Valuation Time Bomb

Many obsolete venture capital firm has incentive structures that reward managers for inflated market cap (NAVs) values in order to avoid recognizing the inevitable markdowns. This has resulted in the ‘trap’ of keeping valuations of zombie companies as high as they appear, when, in fact, these companies have no real potential of success.

- The result of this ‘trap’ has been that capital that should ideally be redeployed into new growth oriented investments is instead kept ‘trapped’ by the ongoing burden of management time and expenses attributed to the management of company assets that have no potential of creating value for the fund or its investors. This is poor fiduciary stewardship.

3. For Founders: The Down Round Domino Effect

The founders reading headlines on the boom of AI funding may be misguided; funding has been raised at inflated valuations by VCs that are overly optimistic.

- The Danger: The extreme downward price signals in the secondary market therefore, when the next round of funding comes (which will naturally occur in 18 to 24 months), it will not be flat or up, it will be a significant down round. Therefore, this means a substantial amount of anti-dilution will occur, ESOPs will be worthless, and it can negatively impact morale and eventually lead to a complete breakdown of company control.

How to Avoid This: The best defence is to develop how to be capital-efficient and partner with a venture capital firm that can establish real, disciplined valuation targets from Day One, as opposed to today’s model of artificially inflating the valuation and forcing a painful restructuring later.

Evolve Venture Capital’s Strategy: Investing for the Real Market Exit

Evolve Venture Capital Investments believes that to make a successful investment, there must be a clear and concise method to exit, regardless of the current headlines and trends in the financial markets. Our investment philosophy is one of discipline through the application of rigorous financial modeling to achieve maximum value within the scope of an unpredictable environment.

1. Public-Private Multiples Parity (PPM-P): The Benchmark of Truth

Evolve’s investment methodology provides discerning investors and resilient market participants a strategic alternative. Our investment approach rests upon three fundamental principles:

- 1. No second-guessing the valuation gap. Evolving uses a proprietary process to ensure that all private portfolio companies of Evolving are measuring their EV/Revenue multiples against comparable publicly traded mid-cap growth companies within their respective market segments.

Example: If a publicly traded mid-cap SaaS (Software as a Service) business has a Forward Revenue multiple of 5 times, Evolve models an Exit multiple of 7 times not 15 times. Evolving uses realistic entry valuation multiples (3-4 times) to establish a reasonable margin of safety for our Limited Partners while providing a clearly defined exit strategy for our Venture Capital firm.

2. Cash Flow Efficiency Over Revenue Vanity

Bear markets require companies to return to fundamental principles. We only work with B2B SaaS and Infrastructure companies willing to achieve free cash-flow positive status within three to four years of launch.

- Advice: A major focus of our advisors for all of our Founders is to prioritize Net- Dollar Retention (NDR) and to minimize the Payback Period for Customer Acquisition Cost (CAC) to 12 months or less. Companies built upon these principles can create businesses that are able to chart their own course and can weather any adverse market conditions without the need to raise new and very costly capital.

3. The Strategic M&A Thesis: Building for the Buyer

Due to the narrowing of the IPO window, M&A will be the only way for companies to get cash quickly. The way that we structure our deals is with an eye toward how the acquirer will look at it from Day One.

- Advisory Services: We work with the founders to find and communicate with potential strategic acquirers (i.e., the largest global technology companies or sector consolidators) as soon as possible during the growth phase of their business. This is not about getting a distressed company to sell; it is about creating a company that has unique and irreplaceable strategic value to the acquirer. A company can have unique intellectual property (IP), a significant customer base within the Asia-Pacific (APAC) region, or a database that will support the acquirer’s revenue under their current product/service offerings. It is the task of the advisors to assist the founders with setting up their data rooms, developing their IP structure and methodologies to develop their financial governance to M&A standards, before they reach the Series A round.

A New Era for the Disciplined Venture Capital Firm

The current bear market phase is not an end to the bear market; however, the bear market has transitioned from all sectors of the economy to individual sectors and is now an extreme disconnect from each other. In this new era, we are seeing significant capital flowing into artificial intelligence and fewer capital flows into the rest of the venture capital industry, and the overall venture capital liquidity structure is showing signs of that stress through the huge discounts being applied to all venture capital investments in the secondary market.

These significant challenges within the industry are providing a tremendous opportunity for venture capital firm that have consistently deployed capital with a disciplined approach and with thorough analysis. In addition, as a result of these challenges, we are seeing more and more opportunities for discerning investors to deploy their capital with those venture capital managers who understand that their ultimate success is based on cash return on capital invested (DPI) and not the theoretical value of their unrealized investments.

This is also a great time for entrepreneurs and founders to identify venture capital partners that will be committed to the long-term success of their businesses and protect their ownership of their companies by requiring and administering realistic milestone-based funding with a clear path to profitability.

At Evolve Venture Capital, we are not waiting for the public markets to signal the end of the bear market before

we begin growing our portfolio of venture capital investments. Instead, we are actively investing our client’s capital in this ‘hidden’ market signal and taking advantage of today’s relatively lower pricing of venture capital investments, enabling us to maximize the upside when we execute intentional, high-value exit transactions of our portfolio companies tomorrow.

Do You Want a venture capital firm Focused on Real Returns that Works Together with Investors?

If you are an investor looking for a venture capital firm with a disciplined and provocative investing philosophy, or if you’re a founder creating a well-planned capital-efficient company with a concrete roadmap to profitability, we want to hear from you.

At Evolve VC, we provide both the tools, data, and thoughtful advice to help you navigate through the difficult last phase of this investment cycle.

Contact Evolve Venture Capital today!

Email: contact@evolvevcap.com

WhatsApp: +6581814097